Sometimes it’s urgent to get some money really fast, so you can use special micro loan apps for such a purpose. Here, there is a list of best micro loan apps for the USA and you can choose one or several most suitable for you. And before getting that loan, you can also use free personal loan calculators in order to plan everything in advance.

Vola Finance

Vola Finance helps people manage their money better, offering help especially to those with low to nonexistent credit scores.

Vola’s main feature is simple yet impactful: offering cash advances up to $300 instantly. It’s like an early payday for many, allowing access to funds before their paycheck lands in their bank account. What really catches the eye, however, is that there’s no credit check or interest rate. That really opens the doors to a lot of people.

There’s also an alternative to direct deposits for cash advances – the Vola Card. Users who would rather not have the money sent to their bank accounts can request this virtual card. All future advances would be sent there. Plus, they can use it to shop.

Let’s not forget about Vola’s spending analytics tool. This feature is a window to the user’s spending habits. It gives insights, helping individuals budget wisely and possibly pinpoint areas where cuts can be made.

Vola Finance has its limitations despite the features it provides. The maximum cash you can advance is only $300, which is quite low. Also, the unclear details about different membership levels and their cost might discourage some people.

To sum up, I’m sure Vola Finance serves as a handy tool for managing money and preventing overdraft charges, especially for those with fewer credit choices.

You may also like: 11 Free Loan Calculator Apps & Websites

Omega Loans

Omega Loans is an easy-to-use app where you get the money you need, quick and simple. It gives you an instant loan in a day. You can borrow between $50 and $2000. Good for emergencies or urgent purchases.

You fill out a form. It asks for straightforward details like your name, phone number, and email. After the loan is checked and given the thumbs up, you get told about it and given a loan agreement. You can even sign this online to finish off your application.

One cool thing about Omega Loans is fast money delivery. Once your online signature is done, the money usually hits your bank account that same day. Some lenders are super speedy, getting the payday to you almost instantly. Of course, your bank needs to support quick pay services.

Omega Loans doesn’t beat around the bush. No hidden costs, just a service fee and a one-off late fee if you miss your repayment. The total loan sum never changes. That way, you know exactly what you need to pay back.

If you pay back Omega Loans on time, you may get a chance to raise your credit limit to $2000. A flexible range of 3 months to 2 years is given for payback time. You’re granted 62-day periods for any loan repayment.

The app caps the annual rate (APR) between 16.50% to 21.00%. For a $1000 loan over a year at 14.9% interest, you’d pay $89.77 monthly. Total payback: $1077.24.

All in all, I find Omega Loans is reliable and simple for quick financial help. Features like fast fund allocation, clear fees, and security make it attractive. But be sure to understand all terms, particularly relating to interest rates and payback, to fit your financial reality and goals.

Loan Droid – Personal Loans

Loan Droid is a fast and easy way to get payday and personal loans approved. With Loan Droid, you can get short-term loans up to $5,000.

The app caters to all credit types and provides loans with fair rates and zero hidden charges. Payback time can be as short as 3 months, or as long as 36 months, to fit your financial situation.

But not everything about Loan Droid is perfect. Since the app matches you with lenders, it can’t tell you the exact annual interest rates upfront. Rates can fall between 4.99% and 35%, and this range may make it hard for users to neatly calculate the full cost of a loan.

One possible downside could be the payback time. It’s from 90 days to a year. If you need a loan for a longer time or a more spread-out payment plan, this might not work for you.

To wrap up, Loan Droid is good to go for personal finance. It doesn’t matter what your credit score is, Loan Droid can help.

Borrow Money App: Payday Loans

For anyone in a tight financial crunch, this app lends a quick helping hand by offering short-term cash loans right when needed the most.

Developed by experts in credit handling, this app takes the fuss out of borrowing cash. Its payday loans start at $100 and can go up to $1,000. What’s a payday loan? It’s simply an advance on your paycheck, offered by a lender, not your boss. You borrow a bit of money to pay back immediately or latest by your next payday. Remember, there may be some extra fees.

You don’t have to spend time in lines or deal with paper documents. All it takes is a few taps on the app, right from the coziness of your house. Select how much you need, key in some information, provide your bank details, and boom! Your loan is sorted within a business day.

Let’s say you have bad credit. It’s not an issue with this mobile platform! This app connects users to a network of lenders who care more about payback capacity than credit scores. Fair evaluations are assured if your application meets the minimum criteria.

Before giving a loan, lenders must share the complete loan terms. This includes the principal amount, fees, annual percentage rates (APR), and payback timeline. Bear in mind, these terms may shift depending on both the lender and the state.

Overall, the Borrow Money App is a quick, easy-to-use solution for short-term loans. It’s a welcome option for those in immediate need of cash.

Pigeon: Lend Money Your Way

PNo more uncomfortable situation of managing private loans with friends. I’m sure that with thanks to this app ypu can set your own loan conditions, send funds, and track their payback, all in the app. It makes sure everyone knows the loan terms and payback plan, stopping any future argument or dispute.

But Pigeon isn’t just about loaning money. It’s about maintaining good relationships. Its design helps avoid unpleasant debt conditions by introducing a clear, formal framework for personal loans.

This option is perfect for those who want to back others financially, like in emergency situations, funding a startup, or assisting with big purchases.

This app gives room for tailor-made loan creation where users can decide the loan’s time, main amount, and interest rate. It gives users the power to tweak loans based on their wishes and the borrower’s requirements. To top that, the app allows for the signing of credit contract and papers right within the app, assuring comfort and safety for everyone involved.

On top of these features, Pigeon provides expert guidance on private money lending. There’s also a wealth of resources to educate folks on finance. Having this information at their fingertips equips users to make smarter decisions about loans. Plus, they’ll get the hang of the ins and outs of private lending.

To sum it up, I believe you should really try the features of this app as it provides a convenient way to get a micro loan.

Pocket Money: Payday Loans App

Pocket Money: Payday Loans App is a quick-fix financial tool by Pocket Money Limited. This app, highly rated by its 3,800 plus users, makes getting payday loans smooth and fast.

Pocket Money stands out with its openness about Annual Percentage Rates (APRs). How much APR might you get? Anywhere from 4.95% up to 35.95%! It depends on factors like your credit score, financial past, and income.

The clear info on rates and fees helps users know what they’re getting into. Let’s say you borrow $5,000 over 48 months with an 8% fee. Your monthly repayments? A crisp $131.67. That brings to a total payback of $6,320.12, fees included. That’s an APR of 18.23%. Clear as day.

But, there’s a downside. High APRs, up to 35.95%, can lead to big payback amounts, which might be hard for borrowers to handle. It’s important for them to tread carefully and truly grasp any loan terms. Adding to this, the fact that one’s credit score and financial past are used to decide eligibility and rates might exclude those with bad credit.

Last of all, I think the Pocket Money app is a modern fix for quick financial needs, balancing accessibility, clarity, and privacy. However, users must treat payday loans thoughtfully, fully understanding the conditions and ensuring they can stick to repayment schedules to dodge money troubles

You may also like: 9 Best Installment Loan Apps for the USA

Sonata Loans: Cash Advance

Sonata Loans is an app that offers loans. It’s quick and easy – you can get installment and advance cash loans in no time flat. You can even get up to $2500. It’s simple – just fill out a form. Also, you can keep track of your account history and get reminded about payments.

Sonata Loans helps people with various credit ratings. Even those with not great credit. It helps find online payday loans, installment loans, and credit lines. The Annual Percentage Rate (APR) it provides changes from 5.99% to 35.99%.

People often seek quick loans and this app looks like a good solution. But, remember, it could cost a lot. High APRs mean the loan could get expensive later on. Easy availability of credit might lead people to not think much about the future and borrow irresponsibly. Like every financial product, check your needs and your pocket before you borrow.

To my mind, Sonata Loans seems like a handy, safe, and diverse platform for loans. It works for those who need money fast. Its promise to keep your information safe, range of borrowing options, and flexible conditions make it standout among digital lending options.

Prosper: Personal Loans

Prosper’s Personal Loans app simplifies personal finance, focusing on loans. It’s easy to use and helps both new and existing borrowers manage their loans.

The app is super straightforward. Want to check out potential loan amounts, interest rates, or monthly payments? No sweat. You don’t even have to give your phone number or email. Privacy? Check. Convenience? Check. Our application process is a breeze. It takes less than five minutes, and if all goes well, you get the funds the next business day.

With Prosper, your interests are locked and rates low. You can borrow anything from $2,000 to $50,000. The Annual Percentage Rate falls somewhere between 6.99% and 35.99%. The more you impress us, the better the rates! It’s flexible, adjusting to different financial needs and borrower types. You can choose loan durations between two and five years, making sure the loan fits just right for you.

The app is a real help for borrowers. With fingerprint or face recognition, users can get to their My Prosper account quickly and securely. This biotech feature drops the need for old-style passwords. With the app, users can make payments, plan automated payments, and watch their loan repayments progress, right from their mobile device.

In conclusion, I can say that this app is a great choice for people who want to take a micro loan. It gaves you a chance to rely on a bank and cover you financial needs.

Brigit: Borrow & Build Credit

Brigit is an app with four million-plus users. It helps with budgeting and building credit.

You can get $50 to $250 when you need help right away. The cool thing is how it handles repaying. It reminds you a day before payment is due. Then it takes the money straight from your bank account. No surprises or extra charges. Great for short-term money troubles.

Brigit does more than just quick cash. It also helps build credit and save money. Here’s how. There’s a 24-month credit term. The annual rate is 0%. This pushes money stability and growth.

You start building credit by adding just $1 each month. The rest comes from a new account in the app. This helps improve credit score without hard credit checks or high rates.

Another neat feature is its budgeting tools and financial breakdown. You can link your bank account to check your money traffic. This gives a clear look at where you stand money-wise. Even better, it can predict and prevent overdrafts. This keeps you clear of fees that happen when your account drops too low.

To sum up, Brigit stands as a diverse financial tool. It offers services like cash advances, credit improvement, and budget planning. However, they should know the potential charges and see if it syncs with their financial goals and situations.

Kikoff – Build Credit Quickly

This is a virtual platform providing resources that focus on things that impact credit scores like payment history, credit use, and how old their accounts are.

Kikoff provides a straightforward and just route for clients to improve their financial health especially useful for people in various stages of their money life.

Let’s look at a top Kikoff feature, a credit line designed for folks wanting to raise their credit score. This $750 credit line doesn’t have any interest payments or fees, making it budget-friendly for members.

Finally, Kikoff offers a unique, easy-to-understand method for people to boost their credit levels, particularly those who are starting from low or zero credit. Its straightforward style and lack of extra charges make it a considerable choice.

You may also like: 11 Free Auto Loan Calculator Apps & Websites

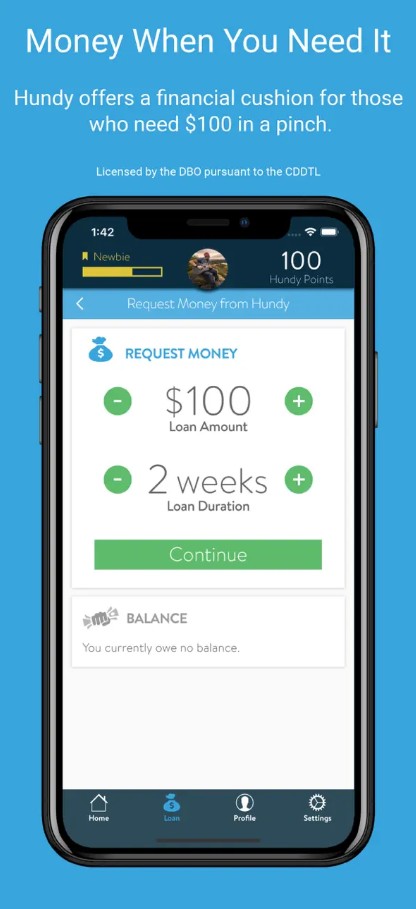

Hundy – Money When You Need It

Hundy is an app that delivers fast financial help. It’s a peer-to-peer platform that gives quick loans. It’s not like classic banks or other finance services.

Its main job is to get deposit advances to you fast. This is great for folks who need cash instantly. You can ask for advances between $25 and $100. If you qualify, you can raise your limit to $250. To apply, log in with Facebook or Apple ID, connect your bank, check your identity, and pass a swift risk check.

Hundy interests many because of its no-fee strategy. Rather than set fees, users can donate after payment. This is a significant shift from usual fee structures. It’s helpful for users watching out for surprise charges and high interest.

You can also choose when you repay your advance. You can delay or pay off your loan within 61 days, with no penalties. If you can’t pay within 61 days, Hundy lets you turn your advance into an installment plan. It lasts 60 days, with no penalties or fees.

Hundy brings a new twist with its community-first touch. People score points and step up through ranks as they get involved in the community and repay their loans punctually. The Hundy Hub lets folks share and celebrate their money win-wins with others.

In short, Hundy is an easy-to-use tool for anyone needing money in a hurry. Its zero fee, repayment flexibility, and community speak loud.