In today’s digital age, checks are still a common way to receive payments. But with the rise of counterfeiting, how can you be sure the check you’re holding is legitimate? Fret no more!

This article unveils top-rated apps, compatible with both Android and iOS, designed to empower you with check verification.

Whether you’re a business owner, a freelancer, or someone who occasionally deals with checks, these apps offer peace of mind by utilizing advanced security features to identify potential forgeries. So, ditch the uncertainty and keep scrolling to discover the perfect app to safeguard your finances!

For managing your finances efficiently and ensuring the authenticity of your checks, consider exploring these best checkbook register apps.

Bin Checker – Check & Validate

BIN Checker promises to be a one-stop shop for validating various financial information on your phone. Let’s delve into its functionalities to see if it lives up to the claim.

The app’s core strength seems to be Bank Identification Number (BIN) lookups for credit and debit cards. It can reportedly reveal the issuing bank, card type, and even the country of origin. This can be helpful for preliminary verification when receiving card details online.

While BIN Checker claims to validate card numbers, it’s important to remember this doesn’t guarantee the card’s legitimacy. Real card numbers can be stolen and used fraudulently. True card validation typically requires additional steps implemented by merchants or financial institutions.

BIN Checker extends its reach to IBAN (international bank account number) validation and IP information lookup. These features can offer some peace of mind when dealing with international transactions or identifying a website’s origin.

The app boasts offline functionality, which can be advantageous when dealing with limited internet access. However, it’s unclear how often the offline database is updated, potentially impacting accuracy.

Free with no hidden charges, BIN Checker seems like a convenient tool for basic financial information checks on the go. However, it’s crucial to remember it’s not a substitute for robust security measures when handling sensitive financial data.

You may also like: 11 Best Free Cash Receipt Generators

Norton Genie: AI Scam Detector

Norton Genie is a free app aiming to be your personal guardian against online scams. This AI-powered tool analyzes text messages, emails, social media posts, and websites to warn you of potential dangers.

Ever receive a suspicious text or an email that seems too good to be true? Simply copy and paste the content or upload a screenshot into the app. Genie will analyze it using advanced AI and advise you within seconds if it might be a scam.

The app can provide tips on how to handle the situation and answer questions you might have about the scammer’s intentions. As you use Genie more, it gets smarter. By feeding it suspicious content, you contribute to a growing database that helps the AI stay up-to-date with the latest scamming tactics.

Norton, a well-known cybersecurity company, backs Genie. This means the scam detection relies on expertise accumulated over decades of fighting online threats.

While Genie is a valuable tool, it’s not infallible. In some cases, the app may not be able to definitively determine if something is a scam. However, it will still offer guidance on how to proceed safely.

Currently, Genie is only available in English. It also cannot analyze scams presented in other languages, though it can still examine URLs within those messages.

Norton Genie can be a powerful weapon in your arsenal against online scams. Its ease of use, AI-powered analysis, and educational features make it a valuable addition to your cybersecurity toolkit. However, remember that vigilance is still key, and no app can guarantee complete protection.

Verify Scams – Powered by AI

Verify Scams positions itself as a comprehensive anti-fraud resource rather than a dedicated check verification tool.

While it won’t directly tell you if a specific check is legitimate, the app offers a wealth of information and support to empower you in the fight against scams. Imagine Verify Scams as your personal fraud-fighting companion.

The app’s core strength lies in its community aspect. By fostering discussions and sharing experiences, users gain valuable insights into various scams and the tactics employed.

This collective knowledge base allows you to learn from others’ encounters and identify potential red flags in situations like check verification. Complementing this is the 24/7 AI-powered VS Chatbot, your virtual consultant ready to answer scam-related queries and provide immediate guidance.

Verify Scams doesn’t stop there. It keeps you informed about the latest scamming tactics through news updates and discussions, ensuring you stay ahead of the curve. This awareness is crucial, as scammers constantly adapt their methods.

By understanding the ever-evolving landscape of fraud, you’ll be better equipped to make informed decisions when presented with a suspicious check or any other potential scam.

In essence, Verify Scams equips you with the knowledge and resources to become a savvy digital citizen. While it may not directly verify the legitimacy of a check, the information and support it provides can be invaluable in safeguarding yourself from financial scams.

Check Card: Credit & Debit

Check Card: Credit & Debit is an Android app that utilizes Bank Identification Numbers (BINs) to uncover details about credit and debit cards. But can it truly determine if a check is real? Let’s dive in.

The app’s strength lies in its ability to decode the BIN, the initial digits of a card number. This provides information like the issuing bank and card type (Visa, Mastercard, etc.). This can be helpful for spotting inconsistencies, like a Mastercard number linked to a supposed Discover card issuer.

However, BIN checkers can’t definitively verify a check’s legitimacy. They rely on publicly available data, which can be outdated or misleading. For guaranteed confirmation, contacting the issuing bank directly remains the safest route.

The app reassures users that it only accesses public data and doesn’t store entered card numbers. This is a plus for security-conscious individuals.

Check Card can be a useful preliminary step when dealing with online transactions. By revealing inconsistencies, it can raise red flags. But remember, it’s not a substitute for verification from the bank itself.

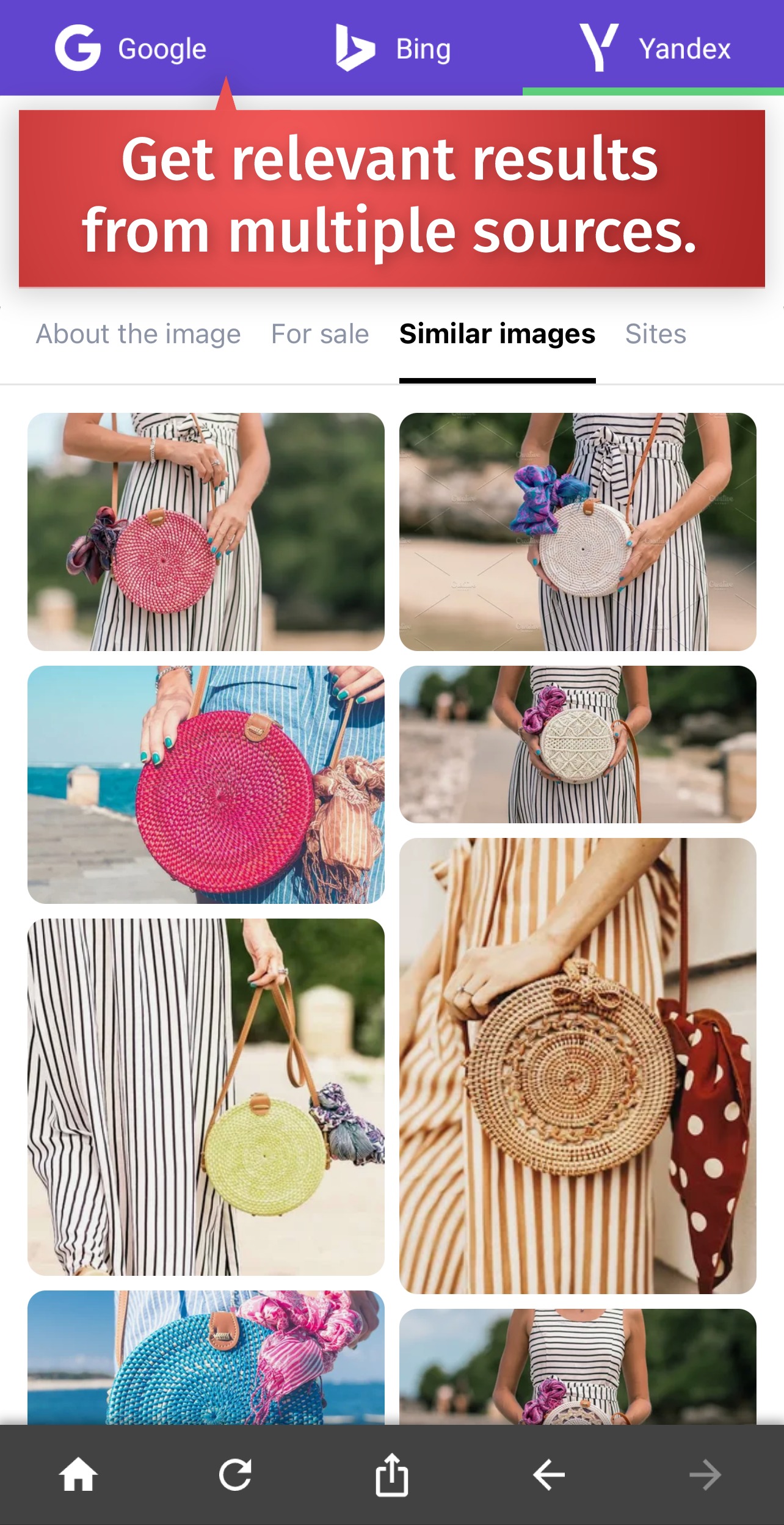

Reverse Image Search – rimg

rimg is a great tool for image sleuthing, but it won’t tell you if a check is real. This app excels at identifying objects, finding similar products, and uncovering the origin of an image through a robust reverse image search. It works by comparing your uploaded check image to vast online databases.

While rimg might return results related to check templates or similar scams if the check image has appeared elsewhere online, it can’t verify the check’s authenticity based on security features or bank information.

These features are unique to each bank and often invisible to the naked eye. Additionally, rimg lacks the secure access to validate banking details encoded within the check itself.

For definitive answers on a check’s legitimacy, it’s best to contact your bank directly. They have the expertise and secure systems to verify checks based on security features, account information, and transaction history.

LEGIT APP – Legit Check

LEGIT APP offers authentication services for pre-owned items, aiming to combat the growing market for replicas. This app could be a valuable tool for both buyers and sellers of luxury goods.

Here’s the breakdown: Trained specialists analyze user-submitted photos to determine an item’s authenticity.

For added security, each item goes through a double-check process by separate authenticators. This multi-step approach aims to ensure accuracy in identifying genuine products from replicas.

Another perk? LEGIT APP boasts 24/7 availability, allowing users to seek authentication anytime, anywhere. This convenience could be a major advantage compared to traditional methods like consignment store visits.

The app also caters to a wide range of brands, with their library constantly expanding. For those seeking extra documentation, authenticity certificates are available upon request.

While LEGIT APP appears promising, it’s important to consider user reviews and independent comparisons with other authentication services before relying solely on this app.

You may also like: 8 Free Receipt Tracker Apps for Android & iOS

CheckCheck

Calling all sneakerheads! If you’ve ever worried about getting duped by a fake pair of kicks, then the CheckCheck app is your new best friend. This service caters to collectors, resellers, and anyone passionate about keeping their sneaker game legit.

Here’s the deal: simply snap photos of your sneakers and their team of authentication experts will meticulously examine them.

Each item goes through a double-check process by two specialists, ensuring a reliable verdict. With over 1.5 million sneakers authenticated to date, CheckCheck boasts a proven track record.

Not only can you verify the authenticity of your prized possessions, but the app can also be used to confirm a purchase before you take the plunge. Feeling unsure about that online deal? CheckCheck can provide peace of mind and stop you from unknowingly spending your hard-earned cash on a fake.

The app is trusted by industry heavyweights like Complex, Hypebeast, and GQ, adding another layer of credibility. So ditch the sneaker skepticism and download CheckCheck to ensure your collection stays squeaky clean (and authentic).

GPT Detector – Check AI Text

Is that text human-written or AI-generated? GPT Detector aims to be your answer app for Android and iOS. This app promises to scan text and PDFs for signs of AI authorship, particularly from models like ChatGPT and GPT-3.

Teacher’s Aide or Content Guardian? One key benefit is targeted towards educators. With GPT Detector, teachers can potentially identify student work influenced by AI and ensure assignments are genuinely written.

This app’s utility extends beyond education. Anyone can use it to check text for AI influence, whether it’s a blog post, article, or even a social media message. This can be helpful if you’re concerned about the authenticity of online content you encounter.

GPT Detector also boasts plagiarism checking and intellectual property protection features. By identifying potentially plagiarized content or content that might be AI-generated copies of your original work, it can empower you to take action.

The core functionality relies on an AI algorithm to analyze text and detect patterns indicative of AI authorship. While the app claims high accuracy and is constantly updated, it’s important to remember this is an evolving field, and the effectiveness of such detection methods can improve over time.

Currently, GPT Detector only supports English text. This might be a barrier for users who primarily work with other languages.

GPT Detector offers a convenient way to check text for potential AI influence. While it can be a valuable tool for educators and content creators, it’s worth keeping its limitations in mind.

QuickScan: Document Scanner

While Quickscan is a powerful document scanner app, it can’t definitively tell you if a check is real. There’s no built-in function to verify authenticity through security features or bank checks. However, Quickscan can be a helpful tool in raising initial red flags.

First, use Quickscan’s document scanning function to capture a clear, digital image of the entire check. Then, zoom in on the scan to inspect for security elements like microprinting, a security thread, or a watermark.

Quickscan’s zoom function allows for a detailed view that might reveal inconsistencies in these features. Additionally, check for signs of low-quality printing like fuzzy text, uneven ink, or a lack of perforated edges, which could indicate the check was produced on a home printer.

Finally, while Quickscan won’t verify the routing number, you can look it up online to see if it matches a legitimate bank. It’s important to remember that even with a high-quality scan, these methods can’t guarantee a check’s authenticity.

For definitive verification, always contact your bank directly. They have access to secure databases to confirm the check’s legitimacy and protect you from potential fraud.

iVerify Document

iVerify Document targets individuals who need to verify the legitimacy of checks. It leverages the technology of CCT, a leader in document security.

While iVerify Document itself doesn’t provide details on its verification process, considering CCT’s background, it likely works by scanning a special QR code or manually entering a unique 16-digit code embedded in the check.

These codes, presumably created by the issuing bank and protected by CCT’s anti-counterfeiting measures, should confirm a check’s authenticity.

However, it’s important to note that iVerify Document’s effectiveness relies on the issuing bank or organization using CCT’s security system. If the check you’re verifying originates from a source not protected by CCT, the app won’t be able to confirm its legitimacy.

Before relying on iVerify Document, it’s wise to check if the check issuer utilizes CCT’s services. For added security, consider contacting the bank directly to verify the check, especially for high-value transactions.

You may also like: 11 Best Apps to Scan Receipts for Money (Android & iOS)

Mirage – Detect Image Editing

Mirage advertises itself as an image editing detective, using Machine Learning to sniff out altered photos. While this sounds perfect for spotting a forged check, there are some limitations to consider.

First, Mirage focuses on facial manipulation. If your suspicious check doesn’t feature a person’s picture, the app won’t be much help. Additionally, its “undo editing” feature attempts to revert edits, which isn’t ideal for checks – you need to identify the forgery, not erase it.

While Mirage might be handy for spotting tweaked selfies, it’s not a reliable solution for verifying checks. It’s better suited for detecting facial modifications and doesn’t offer functionalities specifically designed to analyze financial documents.

For check verification, it’s best to consult resources from your bank or financial institution. They can provide guidance on identifying common check forgeries and may have recommended tools or procedures.