Being successful is impossible without making wise financial decisions. Today there are many ways of getting and spending money, and it becomes harder to control it. However, a good budgeting app can help you solve this problem and take your finances under control.

In this article, you will explore the best apps to plan your budget. By the way, if you are looking for some tools to make money by streaming, check this article.

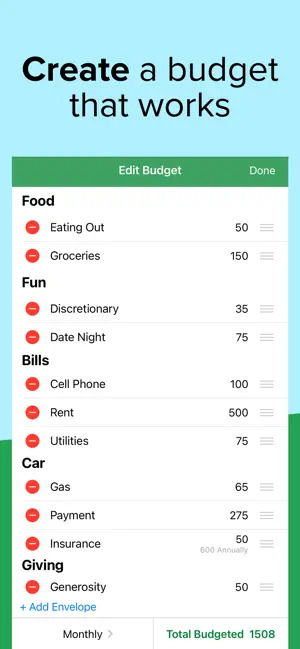

Goodbudget: Budget & Finance

Here comes one of the best money management apps. It combines a financial consultant and a budget planner. Goodbudget will be a good solution both for big families and single people.

The app provides you with a big number of options:

- Add your income and money spent. This is crucial to take your finances under control. If you turn this activity into a habit, then you can see all the data in graphs.

- Use categories. Tracking your expenses isn’t enough to plan a budget. You also need to use categories, such as food, taxi, sports, and others. This will allow you to be able to plan a budget for an upcoming month, as you already know how much you used to spend.

- Add debts. If you borrowed a sum of money from a bank or someone, you also have to take it into consideration when planning a budget.

Goodbudget is simple thanks to its primitive design. Download it and use a proven system of financial management.

You may also like: Best Money Management Games

PocketGuard

If you struggle to control your finances, you need to try PocketGuard. It focuses on managing your expenses, such as subscriptions you forget to cancel or money you spend on food and sports.

PocketGuard is famous for its simplicity. Thanks to good visualization features, you can clearly see where your money goes and how you might save it.

Here is what you can do with the help of PocketGuard:

- Check your balance. The app will show you the difference between your income and expenses. Keep it positive, and you will be able to save money!

- Add your bank cards. You can add all the data about your payments manually, but it is much easier if you add your bank account. In this case, the data will be sent to PocketGuard automatically.

- Add regular payments. This will allow you to see how much you are about to spend next month.

- Track your subscriptions. We often start trials and forget to cancel them, wasting tons of money. With PocketGuard, you can control your subscriptions and cancel them in time.

- Set financial goals. It gets much easier to plan a budget when you have motivation to do it. Financial goals will keep you inspired along the way.

The app is free with in-app purchases. With all the free features, you can start planning your budget effectively.

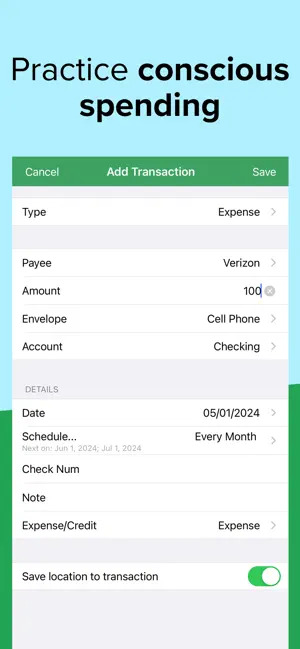

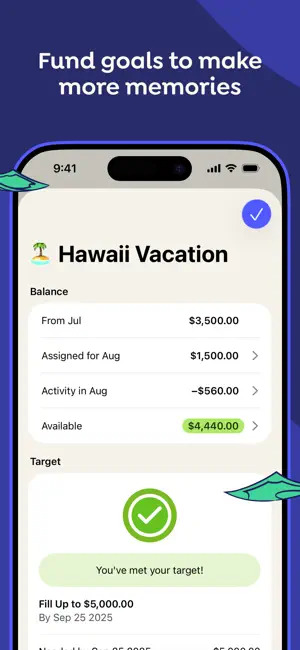

YNAB

This strange name stands for the phrase ‘you need a budget.’ This is what the app was created for. It will help you plan a budget, control your finances, and keep your financial goals in mind.

The app isn’t free, but it has a month trial. 30 days might be enough to study your financial habits and create a budget.

This is why you need to give YNAB a chance:

- Create a plan for a month. You can add different categories (such as food, sports, rent, and others) and plan how much you are about to spend on each category.

- Link your financial accounts. If you have a bank app, you might link it to YNAB. In this case, you don’t need to add all the transactions manually. They will be imported right away, saving your time.

- Visualize your expenses. You will see all the money you spent in a pie chart.

YNAB is a great app that combines a budget planner and expense analyzer. It doesn’t require any knowledge of finances, so you can start right after you download the app.

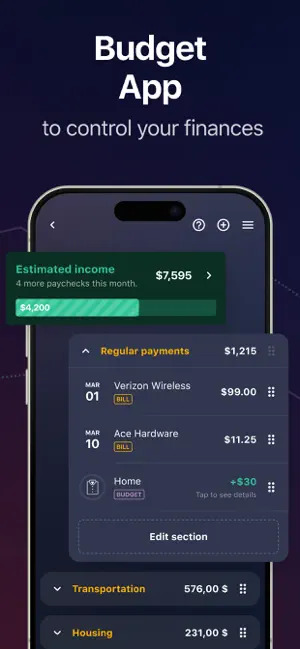

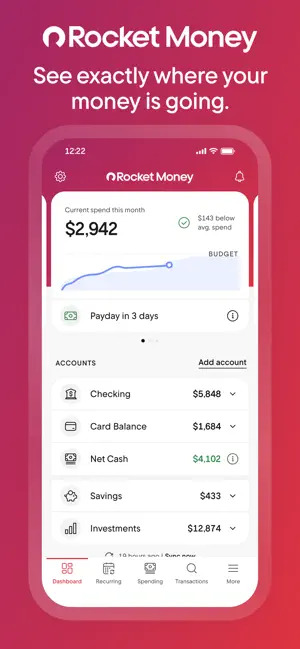

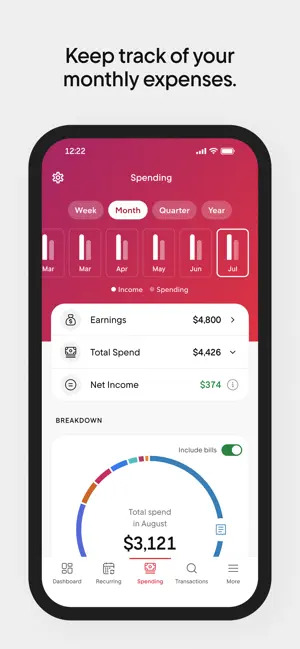

Rocket Money

This app is a good solution for people who want a mixture of a budget planner and an automatic finance controller. If you tend to forget about subscriptions and other expenses, Rocket Money will allow you to take your spending under control.

And, for sure, it allows you to plan a budget for a month. Rocket Money provides you with a big number of powerful features:

- Link your bank to Rocket Money. This is the first step you need to take to automatically track your money. Rocket Money will also divide your expenses into categories and show them in pie chart form.

- Plan a budget. You can do it based on the data you get from your bank application. This is the most reliable way of planning, as you use real numbers from the last month.

- Track extra expenses. It can be anything, from random coffee bought in a hurry to a subscription you forgot to cancel.

As you see, Rocket Money is an all-in-one financial app. Give it a try, and you won’t be lost in your finances again.

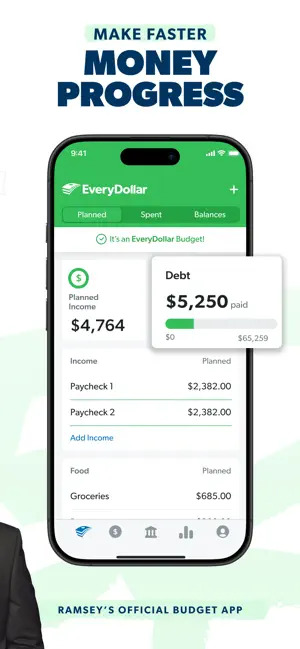

EveryDollar

This is a powerful money app by Dave Ramsey, a famous financial expert. It will allow you to plan a budget, track expenses, and control money in general.

The first and coolest feature is a budget planner. You can choose the period of time and plan how much you are about to spend. You can plan accurately and then compare your planned budget to the expenses in real life.

However, this isn’t the only feature. Let’s take a look at some other options available in EveryDollar:

- See the analytics of your income and expenses. This is easy to understand, as you can view the data in charts and graphs.

- Set your own goals. When you do it, you can edit your budget so that your goals can be fulfilled.

- Track expenses. Sometimes you might forget about little things you buy. With EveryDollar, it is impossible—all the expenses are sent immediately to the app.

- Use a bill organizer. This is a crucial step to always know how much you are about to spend each month.

EveryDollar is detailed and simple at the same time. Try it if you are looking for a tool that will allow you to plan a budget and analyze your financial behavior.

You may also like: Best Subscription Management Apps

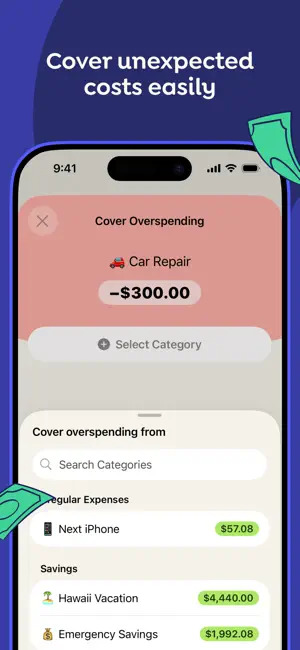

Budget Flow

As you might guess from the name, this app is aimed at creating a budget. The only thing you need to do is to create the categories you want to use and type how much you plan to spend on each of them. In fact, you create a mini budget for every category.

When the month ends, you can compare your budget with real expenses and see if you were accurate enough when planning.

However, there are many other options you might find useful:

- Control each transaction. You can link your bank account and get all the transactions. However, you can also add notes describing each expense and even attach photos. This will allow you to remember when and where you spent your money.

- Scan receipts. This is a super cool feature, as it helps you add transactions in a few seconds.

- Try different recurrent periods. Most apps will give you only one option—a month. However, some people might need to plan for a week or any other period.

This app is a simple and secure solution for problems connected to financial control.

Quicken Simplifi

This app is a good solution for people who run a business. However, it is equally effective for those who want to plan a family or private budget.

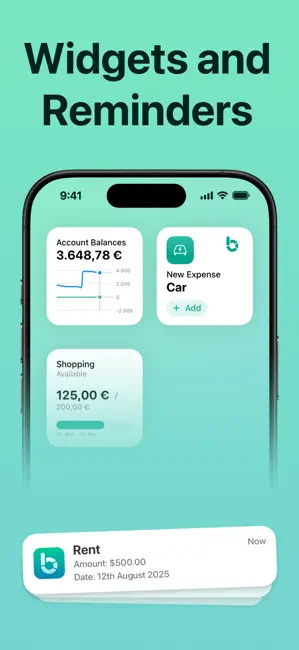

The first feature is the expense planner. You might know (at least, approximately) how much you are about to spend the next month. Create a plan and see if you can stick to it. What is especially cool is that the planner is quite flexible. You can choose any recurrent period and add any type of category to the budget.

The second feature of Quicken Simplifi is a high level of automatization. Once you have linked your bank account, every transaction will be transported right to the app.

Another cool option is the alert system. If you have a bill to pay, Quicken Simplifi will tell you about it in advance.

As you see, Quicken Simplifi is an intuitive and effective tool to manage your budget.

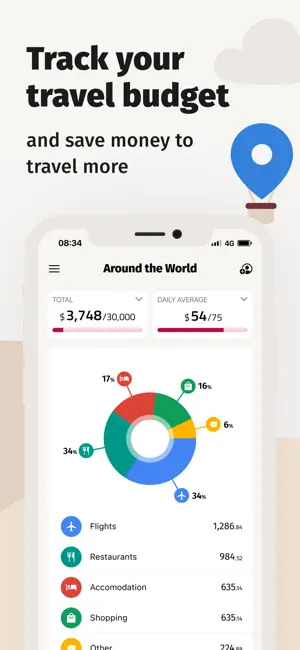

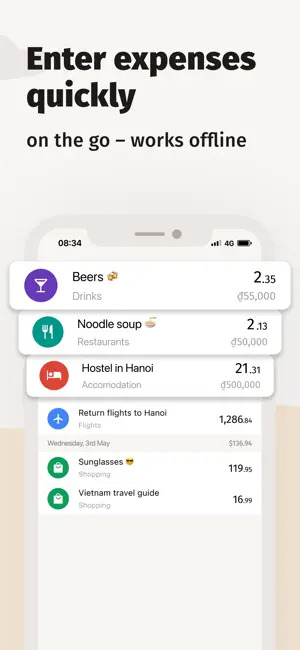

TravelSpend

This is a nice tool for people who need to plan a budget for an upcoming trip. If you have ever planned a family trip, you probably know how challenging it might be. At some point it gets too hard to keep all the possible expenses in mind. With TravelSpend, it isn’t a problem anymore!

Here is what you can do with the help of TravelSpend:

- Create a budget for a trip. It is important that you plan all the expenses, even small ones.

- Use a currency converter. If you travel abroad, this feature is a must.

- Add your real expenses. It will allow you to see how effective you were when planning your budget and how big the difference is.

- Divide expenses. If you want to split the bills with your friends, you don’t need to use another app. Do it right in TravelSpend.

What is more, you can export the data from the app in csv. It will help you to perform a profound analysis in Excel.

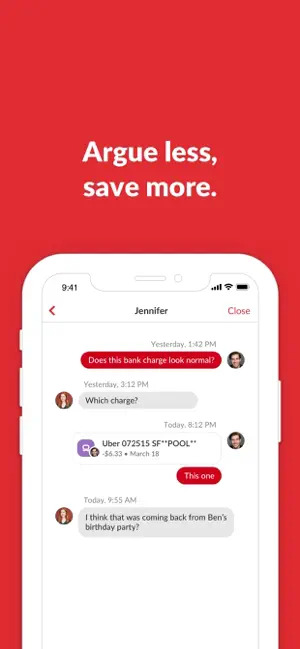

Honeydue: Couples Finance

This is a tool for couples, who need to plan and analyze their budget together. It has all the options you would find in any other budget planner or financial manager app.

Here are some of them:

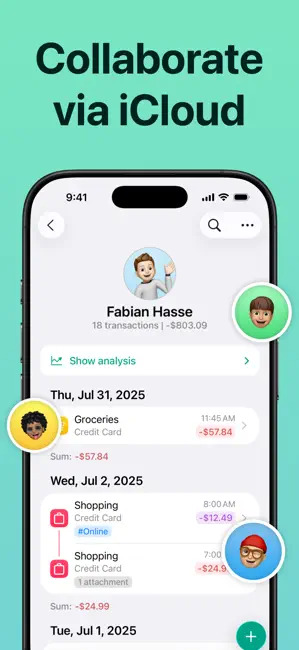

- Create a common budget. To do it, just link your bank accounts, and you will see how much you have together. It will allow you to plan wisely.

- Track every purchase. When your partner makes a purchase, you will see a notification. If you want to ask about it, use the chat right in the app.

- Share your bills. Honeydue is also a good tool to split your expenses. What is especially cool, all the bills will be saved, so you can always see the history.

Honeydue is a comprehensive and simple app, which helps you save money together as a couple and reach your financial goals.

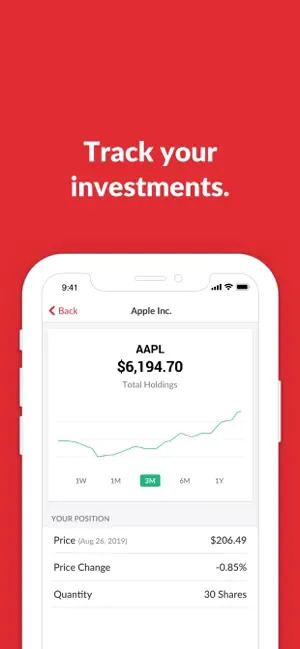

Copilot

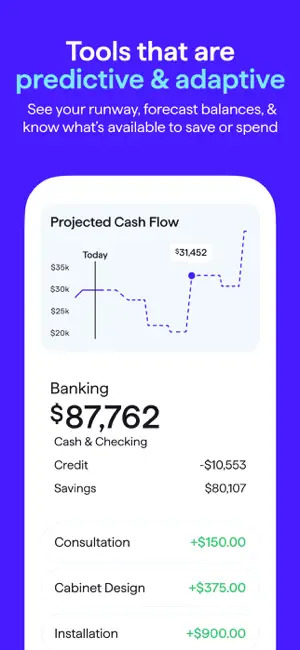

If you are an iOS user and you are looking for an all-in-one financial tool, Copilot is for you. It uses AI to work with your transactions and analyze your financial behavior.

Let’s take a closer look at the features you will discover in Copilot:

- Cash flow analysis. This is a crucial function for budget planning. All the transactions are being sent to Copilot and saved there. What is more, Copilot will also compare your income and spending, highlighting the difference between them.

- AI categorization. You don’t need to categorize your transactions yourself; AI will do it for you. Just link your bank account and enjoy full automation.

- Money goals. You will plan your budget more effectively if you know what you want to achieve. It might be a saving goal, for example.

- Track subscriptions. This is a crucial part of budget control. Copilot will show you all the active subscriptions you have so that you can cancel extra ones.

- Plan your investments. This is also a part of budget planning. You can set an investment goal and track performance.

- Cool widgets. Sometimes you might need to get access to crucial data right away, and widgets solve this problem easily.

What is more, the app is quite elegant and beautiful, especially its dark theme.

The only disadvantage is that Copilot is available on the App Store only.

You can also check: Free Loan Amortization Calculator Apps