Track and analyze family spendings easily! In order to help you, we’ve gathered the 11 best family budget apps in 2024 for Android & iOS. These apps let you keep a record of your fam’s wasting and profits along with setting saving goals.

Wanna teach your kids how to treat money right? This article has you covered: 9 Free Money Apps for Kids

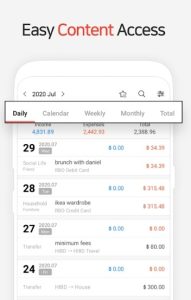

CoinKeeper

Let’s start with the CoinKeeper app. It’s a banking assistant that for your fins.

The main goal of this app is to show you all your waste and earning. To cope with that, the app lets you sort your waste into sections and analyze them all individually. Thus you get to view how much you’ve spent on food, transport, rent, and more. The same goes for the scheduling tool — you can program how much cash you’re going to spend on each class in the coming months.

Thus, you’ll always know where your capital goes and be able to program your expected costs. Herewith, the app has a family acc that lets you trace your family’s cash flow. This type of account runs on cloud sync techs so all your fam could have it on their devices.

All the fam members get to set individual and family assets goals. For instance, you can set a saving found for an upcoming trip or a new TV and all the members could add the cash to it. You can also arrange the app to remind you to save up some cash or pay for stuff like rent or a Netflix subscription.

You may also like: 11 Best Investment Apps (Android & iOS)

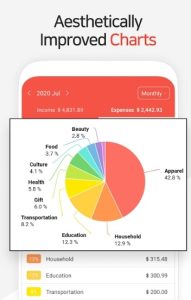

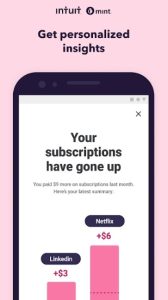

Mint

This is a monetary app that lets you dispose of your fam’s monetary like a pro.

The app runs on personalized analytics techs — it detects your outputs and revenue and gives developing advice. The app breaks all your fins by sections so you can predict the costs for food, clothes, subs, and more. Herewith, there’s a sub-manager that will tell you to pay for all the services you’ve signed up for.

The app covers family accs that let you run your fam’s overall resources. Once you’ll start using the app it will examine your economic behavior and give you a detailed RPT of your economic picture. Thus, you’ll get a clear view of what categories of items you need to buy less and all that.

In case you or your fam members have any credits the app can help with that too. It has a monitoring engine that won’t let you get extra charges. You can also arrange money goals like saving up for something.

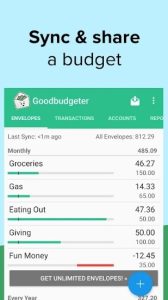

Goodbudget

Next, we have an app that will show you how to spend smart.

It’s a costs tracker that works amazing as a household fins assistant. The concept of this app runs on the envelope system — there are different folders for all kinds of costs. There’s a whole category for household banking, clothes, food, education, subs, and all that.

Additionally, the app lets you add companions you can plan your banking with. The app optimizes on all the related accs of your fam so you get to see the scale in real-time. You can also make scheduled envelopes for expected outcomes and set aims for savings.

If you’ll have any money unspent on any envelop you can transfer it to the next period. In case you need to split a check you can also do that with this app. Herewith, the app will analyze your monetary behavior and give you suggestions on how to get better and save more.

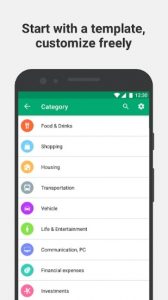

Cubux

If you wanna take your family banking under full control — this app will help.

This app will watch over your regular assets in detail. Of course, you may not stick to the program at first but all good habits take time to incorporate into your life. You can adjust your schedule in detail — from arranging your possible gas charges to cinema trips.

You can also schedule debt returns and set reminders for when the pay date is closed. In fact, you can set various kinds of notifications such as a sub-note, and whatever else comes to mind. The app will trace all your outcomes and split them into sections — food, entertainment, and more.

Then, it will give you alerts on how to use capital wiser and save up. Herewith, the app optimizes on all the devices and web so you can reach it as you want. You also get to arrange fam goals like saving up for smth and all the relatives will be able to add cash to it.

Home Budget with Sync Lite

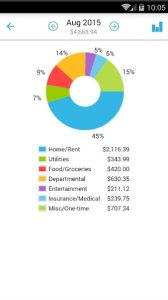

As you can see by the name, this app is fully dedicated to helping you optimize your home assets.

As you can see by the name, this app is fully dedicated to helping you optimize your home assets.

In the first place, it’s a lite (aka free) vers of this app that bounds you with 20 waste and 10 inputs. If you need more you can go for the original version that is paid for. This app not only tracks your family outcome but provides you with assets analysis and insights that are incredibly helpful (especially if you’re not good with economics).

The app covers a family account that lets several devices be involved in one household and change their financial info. Herewith, you only need to sync the devices once and then the balance info will renew automatically on all of them. You get to project your future spending and split them into classes (as it was mentioned you’re limited with 20).

Plus, the app includes the reminders that will tell you to return debt, bills, or whatever else you’ll set it for. You will also get to make fam fin goals and track the entire progress. Then, the app will give you and your fam detailed reports of the outcome that was made.

Check also: 11 Best Bill-Splitting Apps for Android & iOS

Fast Budget

Wanna keep your home fins under command? You can’t go wrong with this app.

Wanna keep your home fins under command? You can’t go wrong with this app.

The app covers all the basic tools you may need to stick to a thoughtful and efficient outcome plan. What this app does is visualize all your family money flow on one page so you could always have a clear view. The outcomes are separated into sections so you see how much cash you spend on driving, bills, and more.

Plus, you can draw your outcomes by the same sections to be aware of how much cash you need each month. In case you won’t spend as much as intended you can put the cash in the savings bar or just move it to the next month. You’ll also get to sync the accs of all your family members to regulate all the outcomes and revenue entirely.

This app syncs to your bank accounts and you’ll get to see the scale right away as well. Besides, there’s a credit card section the lets you handle all your credits wisely. You’ll get to set payday announcements and other stuff that helps you keep your credit history clean.

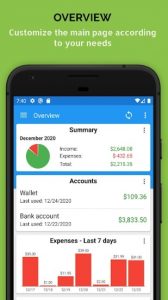

Wallet

This is another fins asst that lets you optimize your household economics.

The main concept of this app is to help you develop useful budgetary behavior. Due to this the app syncs with your bank and gives you periodic announcements on your cash movement. All the outcomes are being split by themes so you can see the amount you need for each category of goods.

Herewith, you get to make a fam acc to handle your home funds right away. Along with basic economics visualization, the app will also send you regular statements with statistics and tips. The app also covers a funds schedule that helps keep your cash in order.

You can also adjust your program to warn you of a bill, credit, sub o whatever else is needed. Besides, you set family-saving aims for all kinds of purposes. You can even use this app for making a shopping list or to-do ones. The app covers several currencies and syncs with cloud services so none of your data will be lost.

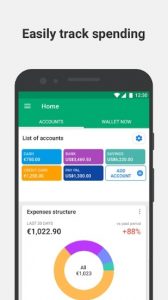

Monefy

Next, we have an app to help you stay in charge of your family’s monetary movement.

This app visualizes all your outcomes and earnings so you can see where your cash goes. Herewith, all the costs are being classified by sections and you get to view detailed outcome reports. The unusual thing about this app is it doesn’t sync with your bank acc.

On the one hand, it aims you to add all your wastes manually which can be annoying. But on the other hand, you can be 100% sure your bank data won’t be leaked. You can also protect the app with a key if needed. It needs to be said, adding an outcome only takes 2 clicks o you won’t need to fill anything but the cost and the class.

Additionally, you get to adjust the sections on the main screen by adding new ones and deleting the ones you don’t need anymore. Wanna share the acc with your fam? You can effortlessly do that. The app easily syncs on several devices so other people could add new records as well.

Zeta

This is an organizer that lets you dispose of fins with your fam.

The main idea of this app is to help you run your capital along with your bf(or other fam members). So if you’re tired of fighting about the fins you can use this app to leave that in the past. As for the tools, this app records all your outcomes, bills, aims, and more.

Herewith, you may rather use all the feats separately or in cooperation with someone — it’s up to you. This app lets you prepare the outcomes in detail. In other words, you can add various classes of outcomes and estimate how much you’re going to spend on it. Additionally, the app syncs with your bank accounts so you can see the scale right away.

Beyond that, the app lets you split the check or transaction easily in a couple of taps. You can also arrange notes to be awarded when your partner spends cash out of your fam assets or adds up to it. Besides, you can alter the schedule of the announcements — from daily to monthly ones.

Honeydue

This is one of the most used economic asst for fams.

Regardless of if you’re in a relationship, engaged, married, or raising a kid — this app is a great way to handle your fins movement. The main concept o this app is to help you and your spouse have a meaningful dialogue about your fundings. To cope with that, the app lets you follow your balances, wasting, earnings, and more.

Herewith, you get to choose how much of your banking info you wanna share with your spouse. Thus, you may rather keep your balance open or private a control the outcome notifications. The app will trace all your waste and split them into thematic sections so you could see where your cash goes.

Beyond that, you can prepare your outcomes in detail by attaching your own classes of outcomes. You can also set several aims and set wasting limits for your fam funds. At that, you can set alerts to stay away from getting any fees.

You may also check: 9 Best Online Payments Apps Without Credit / Debit Cards

Money Manager

And lastly, we have a monetary optimizer that helps you hold the household capital under disposal.

This app lets you keep a trace of all the outcomes of you and your fam. To be more precise, you get to trace all the wastings and earnings to be able to program your resources wisely. Herewith, all your assets are being reflected in a graphic form for easy perception.

The app breaks your wasting into sections so you can see where the whole history right away. Plus, you can draw your outcomes for any period if needed. You may stick to the individual or fam acc — the feats are all the same. The family acc syncs between devices and lets you arrange fam capital goals.

Additionally, the app has a credit manager that helps you to pay your debts on a date and avoid any fees. You can even set an auto return if needed. In case you’re worried about privacy you can set the passcode so you’d be the only one with access to this app.