If you can’t manage to buy something expensive or you can’t start keeping personal savings, then you need to address the issue of your budget.

With these free offline budget apps for Android & iOS, you can keep track of all your income and expenses right on your phone. Enter all the data you need, even when you’re out of network coverage.

Keep tack of all your basic expences using these free grocery budget calculator apps & websites.

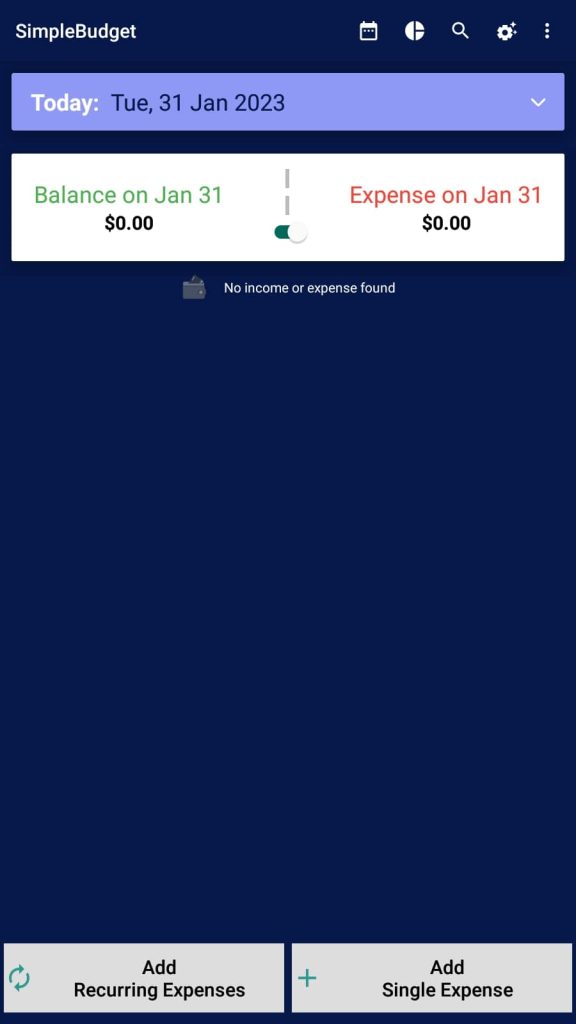

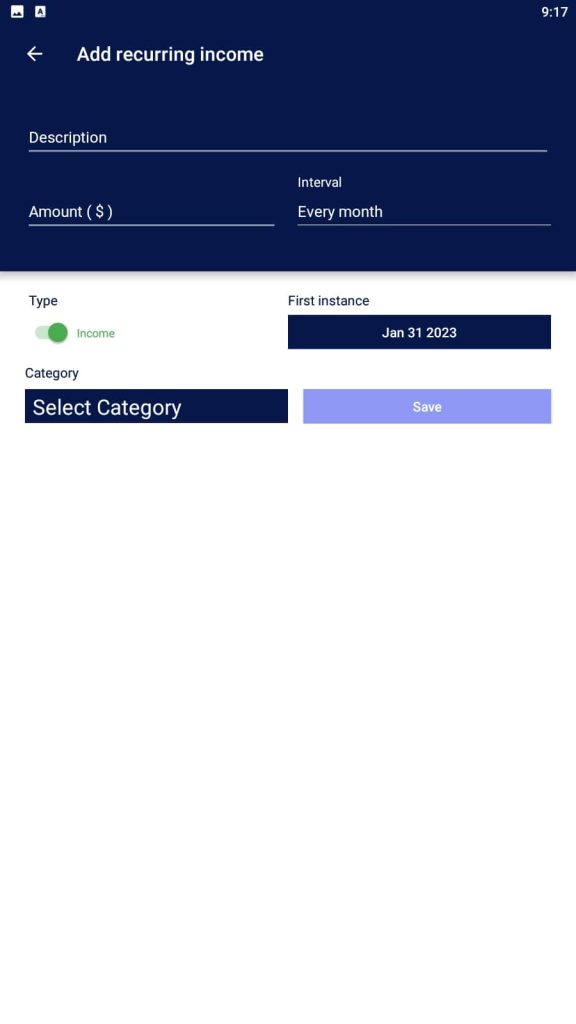

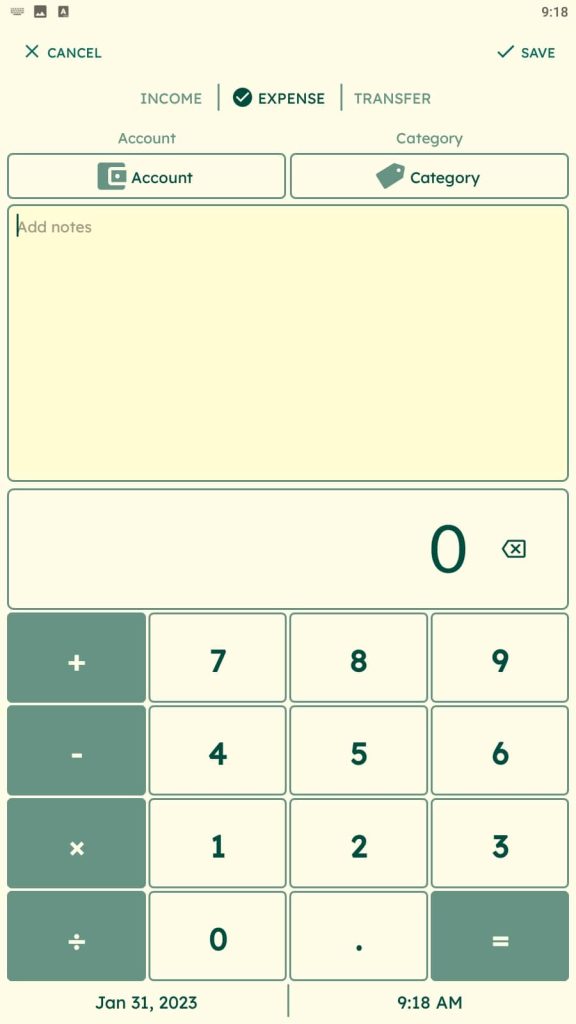

Simple Budget

With this app, everyone will be able to keep track of their spending and receipts, as well as control their entire budget as a whole. It will make it easy to record purchases, big spending, and small expenses.

Based on the budget information received, each user will be able to plan for the future or start saving to increase their average budget.

In this app, you will be able to plan your budget, taking into account spending and income. To keep statistics, it will also have reports by which you can analyze your finances.

You can also use the app to record any regular bill payments so that you can automatically enter them into your planning each month. Regular notifications will come from the app with information and recommendations for savings and expenses in your budget.

You can also save all of your budget reports in storage so they can be retrieved when you log into your account from any device.

The app has extra features that include forecasting your finances, managing your savings, and synchronizing with your e-wallet. In the app, you can plan and analyze your budget in any convenient currency.

You may also like: 11 Best Family Budget Apps for Android & iOS

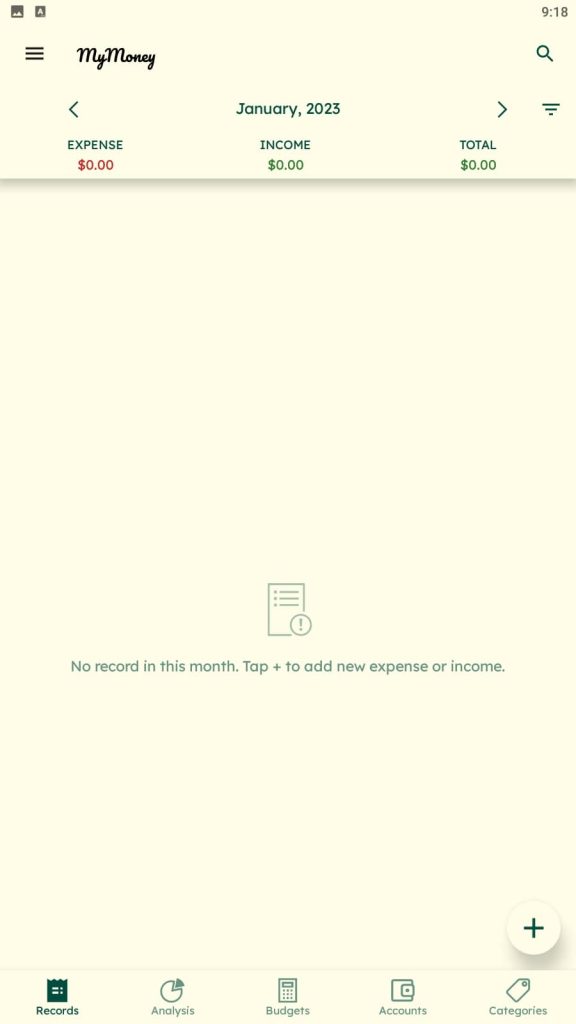

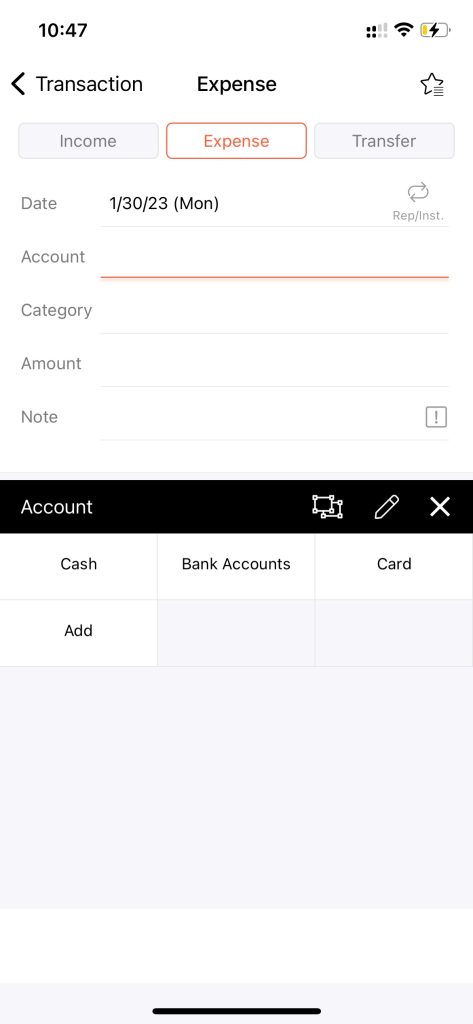

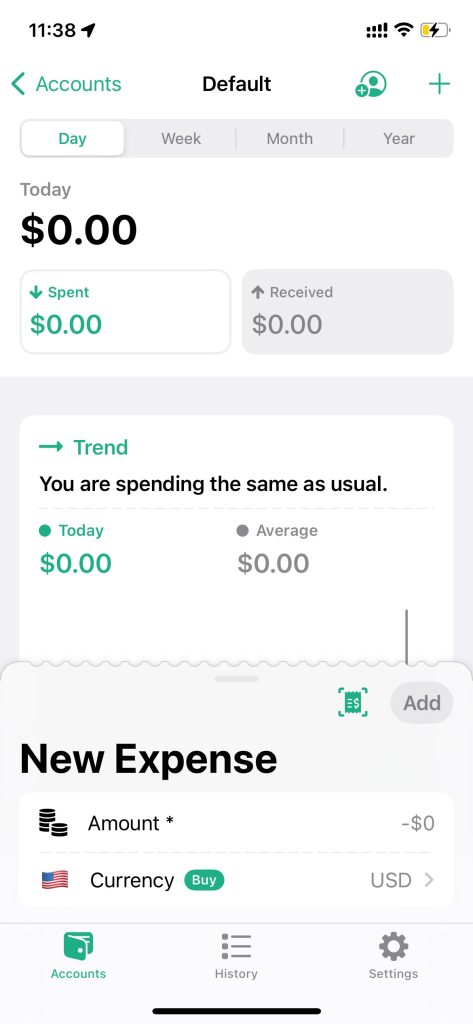

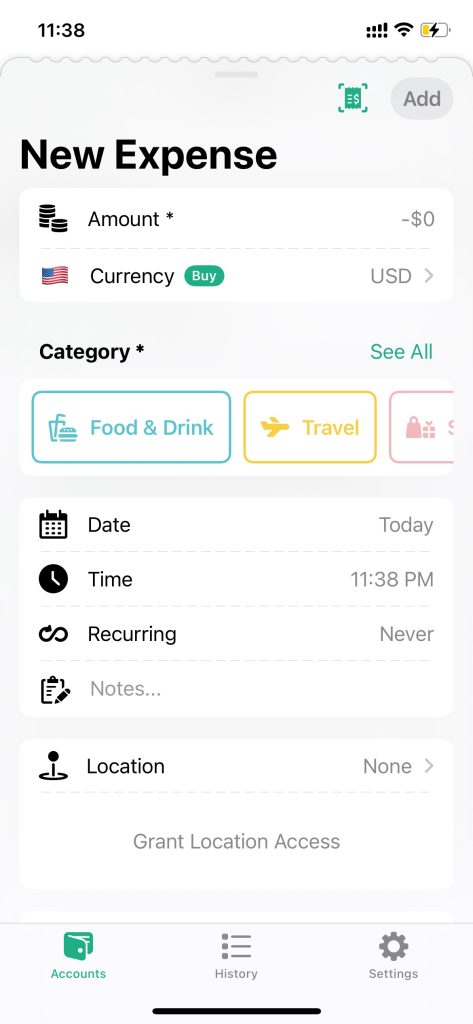

MyMoney

With this app, you can easily plan your financial expenses, keep track of your savings, and even start saving for big purchases.

This service will replace a financial accounting specialist for personal use. It has a budget forecast by which you can calculate your financial capabilities in the long run. You can also analyze and chart your income and expenses in the app.

The app will be easy to understand for all people and even those who don’t work with finances. To keep track of your regular spending, you need to enter data into the app.

The analysis can be done based on a month’s worth of inputs, spending, and more. You can even categorize your income and expenses in the app to better understand your budget and major expenditures.

It also has pie charts, and bar charts. They show the share of expenses and income, track the user’s cash flow, and show the number of contributions. You can also set goals in the app that you want to achieve.

To do this, you should create one or more accounts with appropriate names. You can add an app widget to your Home screen to always be aware of your balance status.

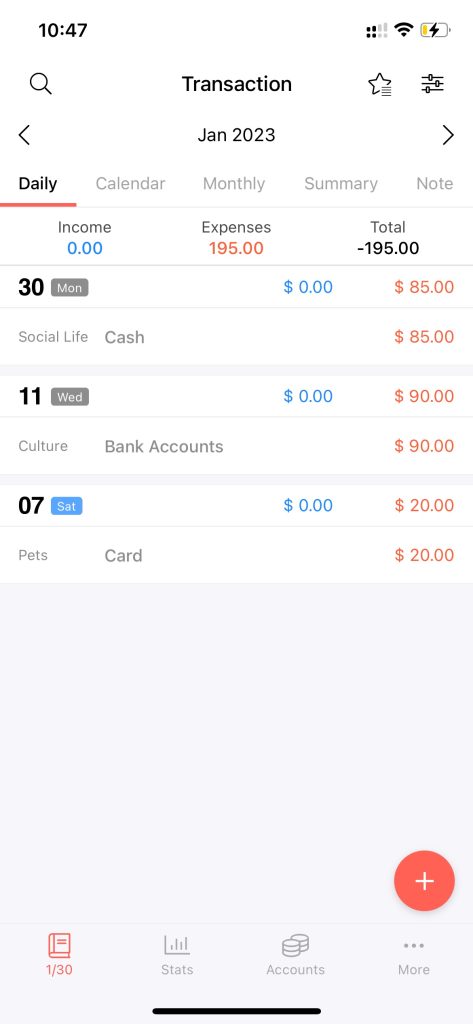

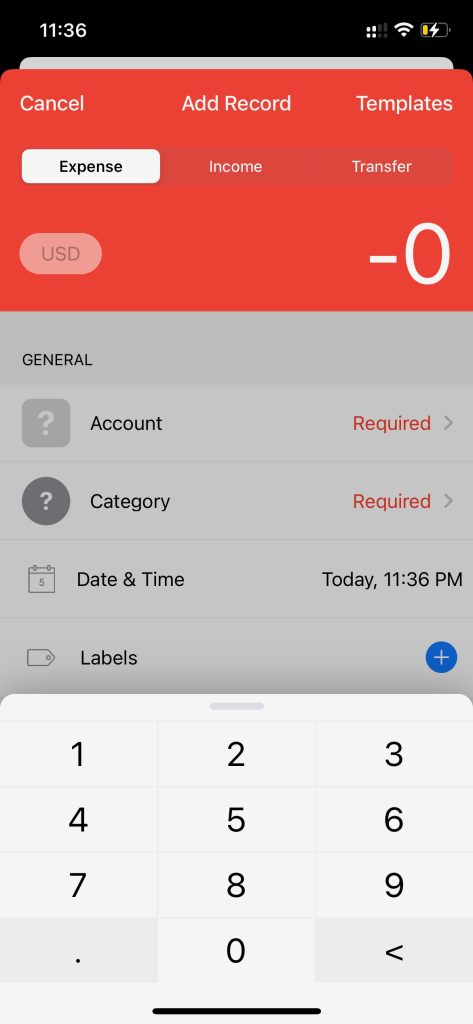

Money Manager Expense & Budget

This service allows you to track and manage your finances. Thanks to the synchronization feature with your PC, you will be able to keep track of all your budget, spending, and expenses on the big screen of your PC.

You can also track the impact of your income and expenses on your budget as a whole. Other assets can also be recorded in the app to get detailed analysis and projections of your financial prospects.

In the app, you can break down your budget into different categories. This will allow you to identify areas where you can save or, conversely, accumulate money. You can set a secure password to protect information about your financial capabilities.

Besides, this service allows you to create recurring transactions to pay loans, installments, and utilities, which will help you not to forget about overdue payments and make them on time.

Also in the app, you can study the statistics of your budget, spending, and expenses on the basis of previously entered data. In order not to lose important information about income and expenses, you can put it in the favorites section.

The app also has a built-in calculator, a calendar to keep your financial records, an app search for quick access to data, and the ability to use subcategories in the main sections.

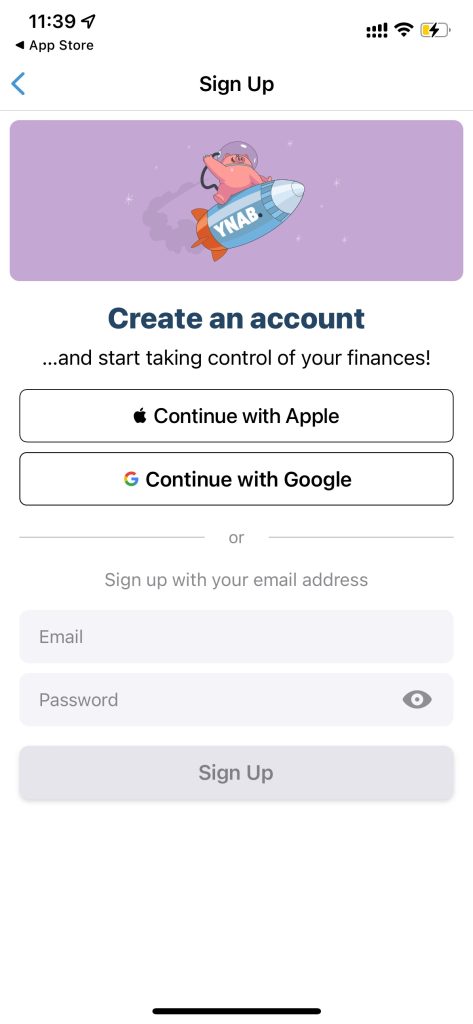

YNAB (You Need A Budget)

This app will help you manage your finances, budget, income, and expenses. You can synchronize it with any bank you use. This will allow you to keep track of all transactions made on your registered account.

With this information, you will be able to analyze your budget, make predictions for the future, and select categories where you can save money.

You can also track your finances from any device, which allows you to make detailed forecasts of your total budget with your partner.

The app has a special tool to calculate savings and funds that have been borrowed. You can use it to calculate the amount you need to make a payment or repay a debt. The app has financial and income reports that keep track of all savings, receipts, and spending.

You can set any financial goals in it and track the path to achieving them. The app is easy to use because it has no ads and no complicated interface. In the app, you can enter information about regular payments, so you can pay them every month and not forget about arrears.

By syncing the app with your bank, you won’t have to enter your income and expense information yourself. It will be automatically recorded in the app.

You may also like: 11 Best Budgeting Apps for Personal Finance

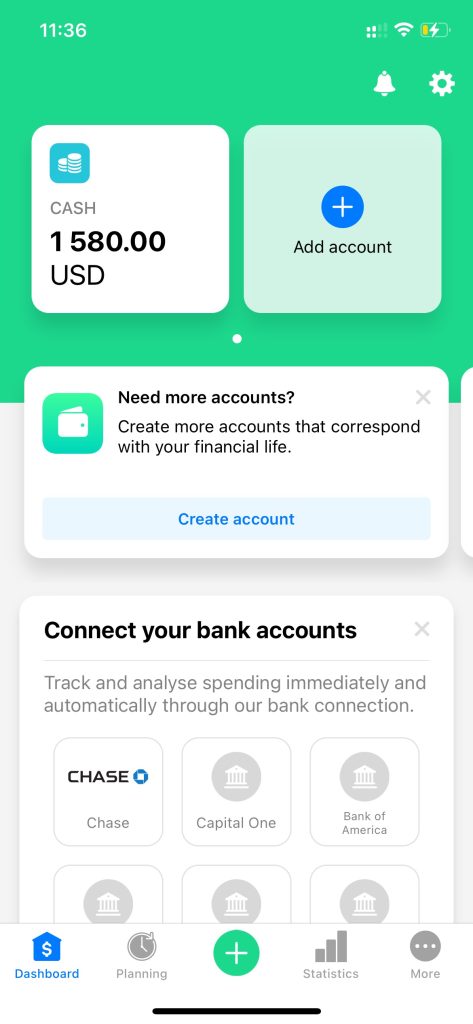

Wallet

The app will help in planning your budget, and managing your financial flow, savings, spending, and receipts. You can add all sources of income and expenses to it to get a detailed forecast of your financial capabilities.

The app syncs with any bank you use, which allows you to get a reliable analysis of your budget.

It can be used on different devices with the same account, allowing you to keep track of your overall family budget or your organization’s budget. You can choose any currency to use the service.

Thanks to the synchronization with the bank, the app will automatically record in the history the transactions that have been carried out on the account. They will also be automatically divided into receipts, expenses, payments, and so on.

In the app, you can calculate the amount to achieve any financial goal and choose a strategy for saving the necessary amount of money. For people who are not versed in financial reports, the app has a special smart assistant. But a detailed report can be analyzed by yourself.

The app offers a variety of charts and graphs to understand your budget, which will display all the information about your financial status.

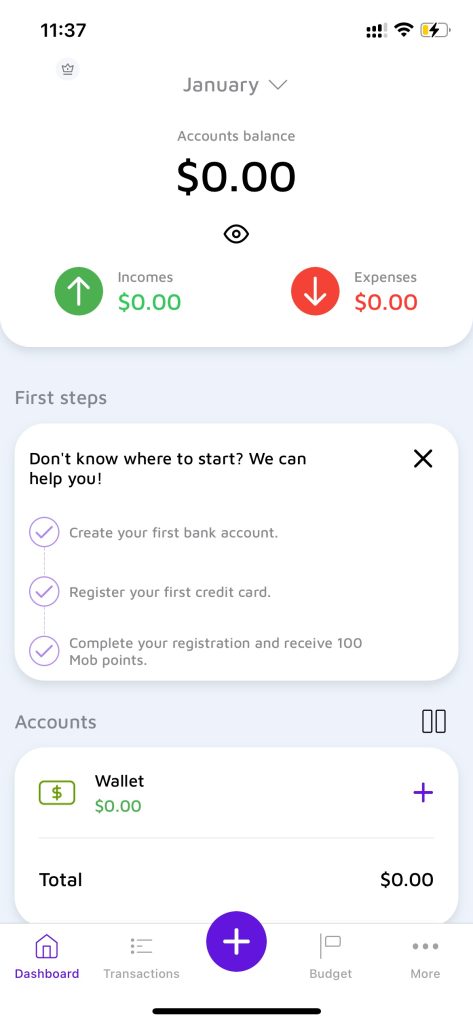

Mobills

Now you can easily analyze your budget and finances. This app can take into account not only expenses and income, but also payments, loans, and installments.

This will allow you to make a detailed analysis of your finances and research it there. The app has a clear and simple interface that allows everyone to use it.

You can add bank cards that you use regularly to the service. This will allow you to analyze your budget in more detail. You can also see your debts, limits, and other bank card information there.

All your finances in the app can be categorized. According to them, you can set various financial goals and even calculate the terms for their achievement.

The app is also convenient with its notifications, which will come shortly before the payment deadline. This will ensure that you don’t forget to pay your loans, installments, and other receipts on a regular basis.

To analyze and forecast your budget, the app has charts and graphs. To record cash spending on purchases, you can use receipts, which are quickly scanned within the app itself.

You may also like: 8 Free Credit Score Monitoring Services (Apps & Websites)

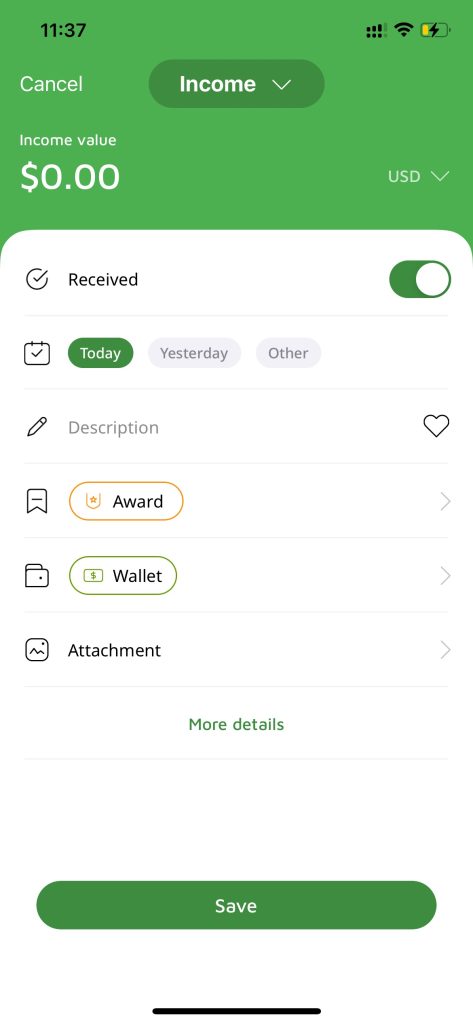

Fin

Fin allows ypu to get a detailed analysis of your budget and learn how to save money to achieve any financial goals.

The advantages of the app are its simple and user-friendly interface. Logging into the app does not require authorization or entering a password.

In the app, you can customize any financial goal and choose a strategy to help you achieve it. You can also add photos and various files to it. Lock in regular payments to activate them automatically.

There are charts and graphs in the app for detailed analysis and forecasting. Widgets are displayed on the home screen for convenience, as it allows you to keep track of your finances and balance without logging into the app.

You can set regular notifications to remind you of payments and other financial transactions. You can export your budget data from the app, allowing you to share it with your loved ones.

The app also has a paid version that gives you access to extra features. By paying a subscription, you can add different entries, share your accounts, multiple currencies, different interface themes, and edit category names using emojis.