Have you ever walked past the shopping window and thought how great it would be to buy everything you want and pay for it later? Or have had to make ends meet until payday? Finding a good BNPL app may seem a very appealing option to solve any kind of money problem.

Here we have listed the Top Buy Now, Pay Later apps for USA. But be careful and repay your balance in time not to let overspending happen! And in addition to that, check also the information about the best cashback apps.

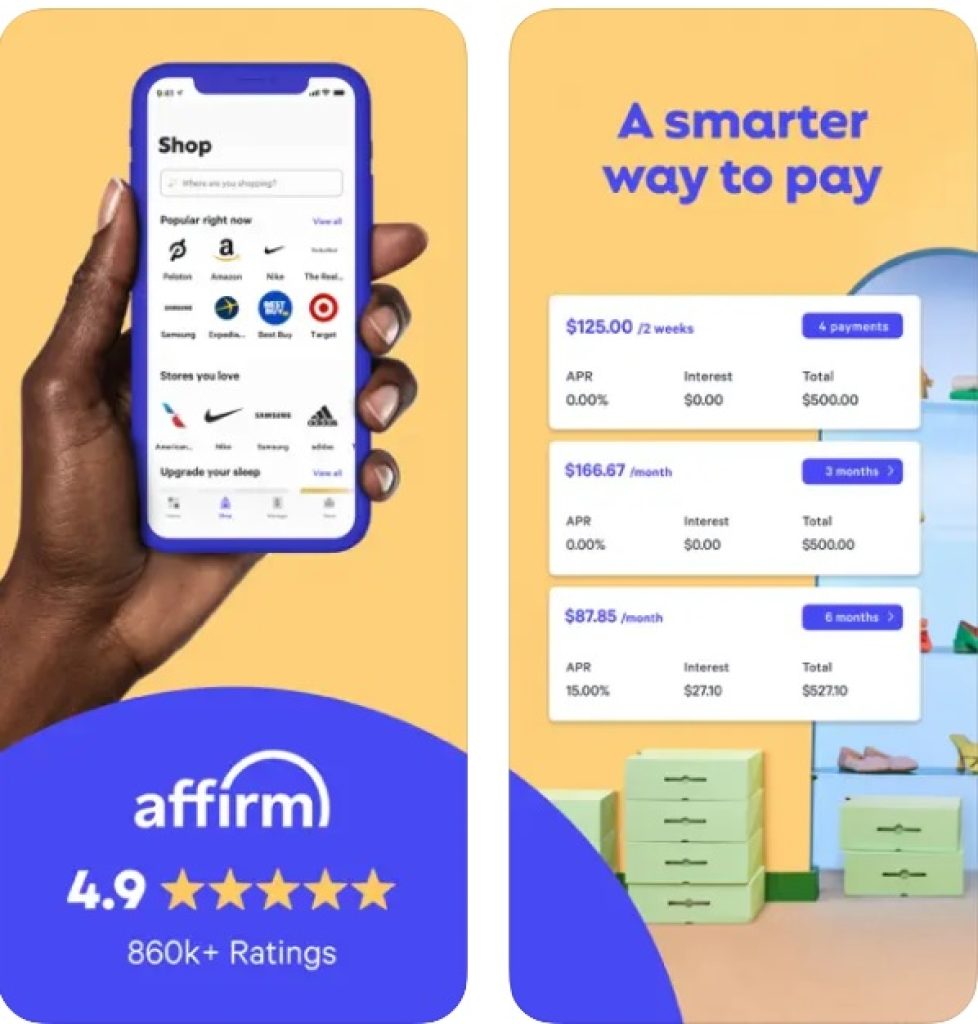

Affirm

Affirm is quite a noticeable option among the rest. It is most remarkable feature is flexibility in terms of paying loans back. Firstly, Affirm, as well as many other apps, offers an option called “Split Pay”: Affirm will divide your loan into four payments with no interest or fees.

You will have to pay every two weeks and can skip the upfront payment.

As for repayment plans, Affirm also offers options ranging from six weeks to sixty months, and it is quite a variety of choices compared to other Buy Now, Pay Later apps.

However, note that if you do not opt for “Split Pay” and choose something else, you will have to deal with an interest rate that is a maximum of 30%. Use the calculator inside Affirm to see your total loan price including the interest rate you will get.

It is also worth noticing that Affirm allows you to take a loan of up to $17,500, which is quite a high limit. Note that whether you qualify for such a sum or not depends on your credit score and payment history.

See what option Affirm can offer you and enjoy shopping with a virtual card anywhere where Visa is accepted.

Key features:

- Flexible and various repayment plans

- No-APR repayment options included

- High purchase limit

- Virtual card

- All merchants available

You may also like: 11 Best Apps like Ibotta to Save Money (Android & iOS)

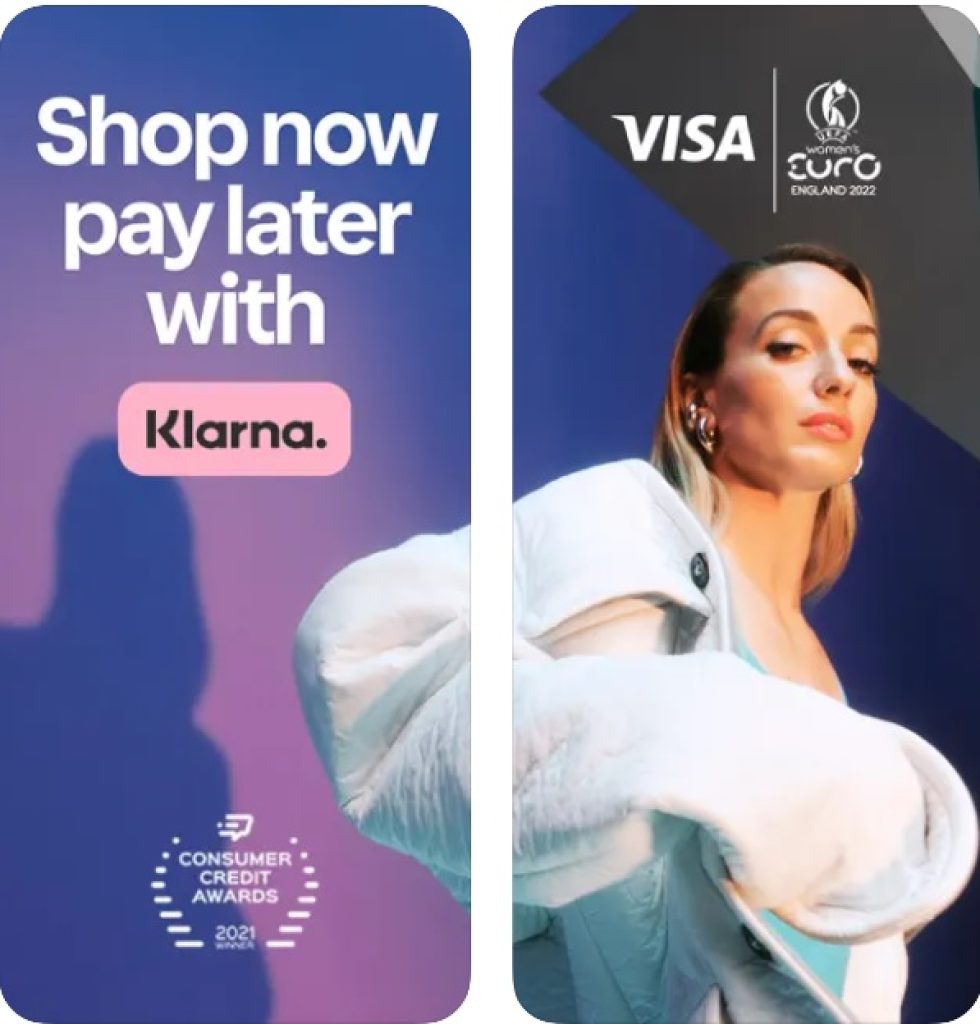

Klarna

Klarna, as well as Affirm, is quite an attractive option notable for the variety of payment terms. It clearly will not allow you to pay your loan back sixty months, albeit with a 30% interest rate, but it also has something to consider.

There are several ways to finance your purchase. Pay in 4 divides your purchase into four parts with no interest that you have to repay every two weeks (and the first payment has to be done upfront).

Pay in 30 does not divide your cost but allows you to pay upfront with no fees thirty days after you have made a purchase.

The longest option Klarna offers is monthly financing. Created specifically for large purchases, it offers to pay the amount back for up to thirty-six months. Mind that the interest rate here would be up to 24.99%.

As for the purchase limit, it depends on your outstanding balance and credit history. What we can say for sure is that you will not get less than 10$. Bad news: if you are late to repay even such a small amount, you will have to pay an additional late fee estimated as 25% of the order value,

Klarna has a partnership with more than 400 thousand retailers that are ready to wait for your payment. We also recommend waiting for the physical card issue: as soon as it will be available, you will be able to use the Pay in 4 option for any purchase, no matter whether the retailer is the partner of the app.

Key Features:

- Three payment plans

- Two plans with no interest

- Late fees

- 400,000 retail partners

Splitit

We simply could not but include this great BNPL service – Splitit. The service calls itself an “Installments-as-a-Service platform”, meaning that your existing credit card would be enough to start shopping with no additional downloads and log-ins.

Once you have signed in through the platform and have authorized your credit card, Splitit will conduct the transaction right through. And it is a game changer: instead of asking for loans from the bank and worrying whether you qualify or not, you are the master of your own money, as it always should be.

If you have enough money on your credit card, choose your repayment plan. Each month automatic payments will be performed, and you choose whether to pay in 3, six, twelve, or twenty-four installments.

No additional fees and no interest rates are charged. Mind that if Splitit isn’t able to renew the following payment, the Total Price will be charged all at once.

To be honest, it’s very pleasant to be called a ‘responsible credit card user’ and be eligible enough to pay later from the very beginning, don’t you think so?

Key features:

- No loans required

- No interest

- Credit cards only

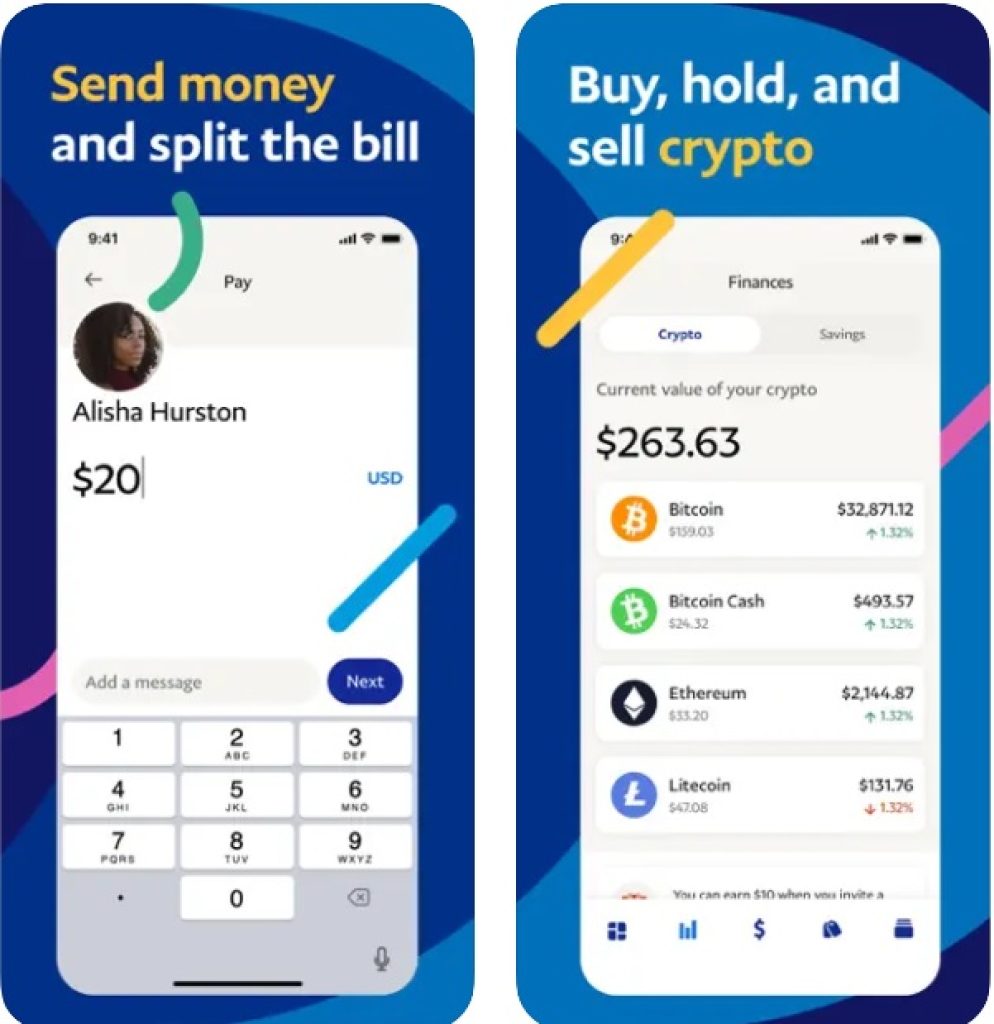

PayPal

The quickest and the simplest option on the list? It seems that you have found what you are looking for. Meet PayPal, created especially to care less about all the details.

What makes PayPal so different is that it does not offer any diverse repayment plans, simply because Buy Now, Pay Later function is just a pleasant bonus feature here. The only plan – Pay in 4 – creates a set of four interest- and fees-free payments, the first of which has to be made upfront.

However, the price you pay not to care too much about all the plans is in the purchase limit. In PayPal, you are restricted to spending $1,500 only. But if we perceive PayPal as just a quick and easy no-frills and no-fees option, everything seems quite logical.

Enjoy your shopping with millions of retailers having a partnership with PayPal and offering it as a payment option.

Key Features:

- One repayment plan

- No-interest and no-fees

- Pay over six weeks

- $1,500 limit

- A wide range of partners

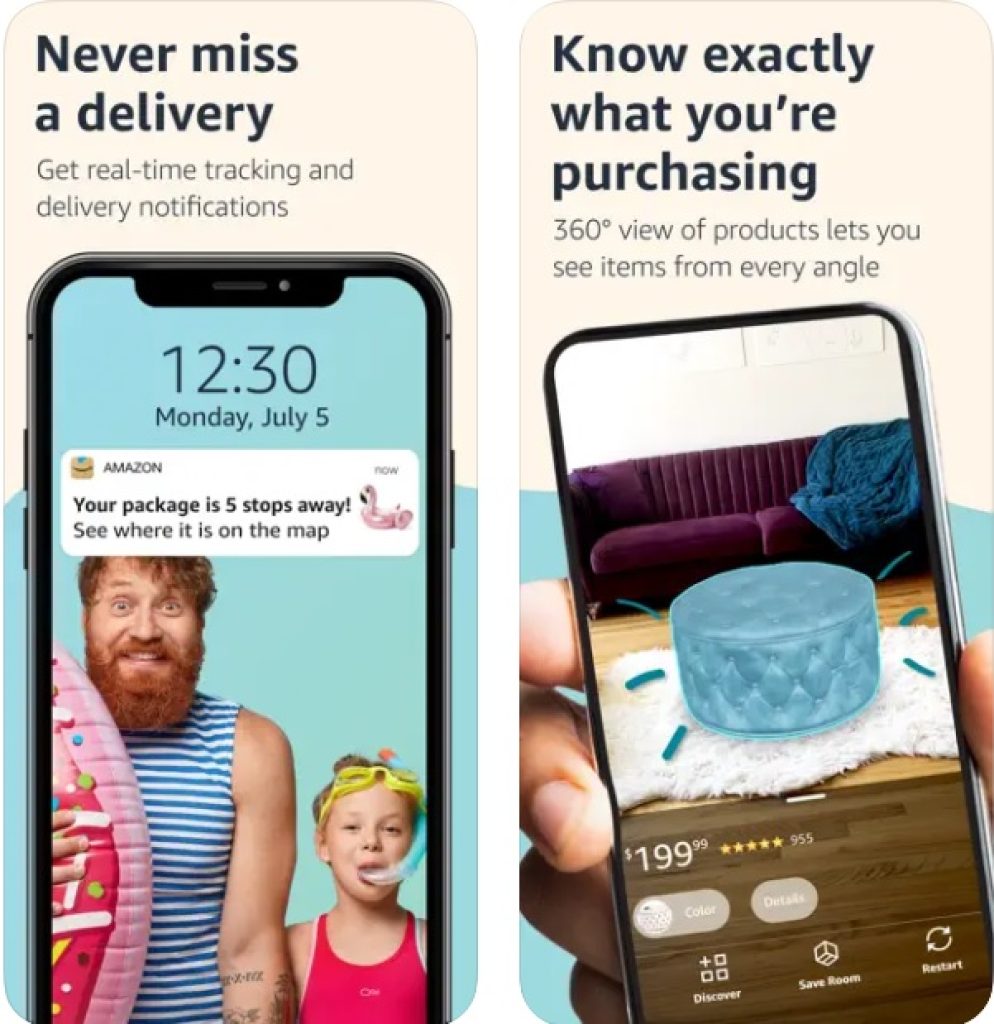

Amazon

How could we leave behind the absolute giant of online shopping? Amazon could not miss the opportunity to provide its clients with its BNPL system. If you want to split your payment while using Amazon, consider trying Amazon Pay Later.

You can use Amazon Pay Later for any kind of Amazon service you like, including booking travel tickets, paying utility bills, and many more. While shopping for goods on Amazon, to activate a BNPL method simply choose at checkout.

The system will range you and offer you to pay at once, next month, or to divide the sum into monthly payments lasting for up to a year.

As for some drawbacks, bad news for those who messed up in the past: to use the service you must have a credit score of 750 or higher, otherwise you won’t be able to use Amazon Pay Later.

Key features:

- No interest

- No fees

- Up to 12 months to repay the balance

- Credit score required

- Amazon database of partnership services

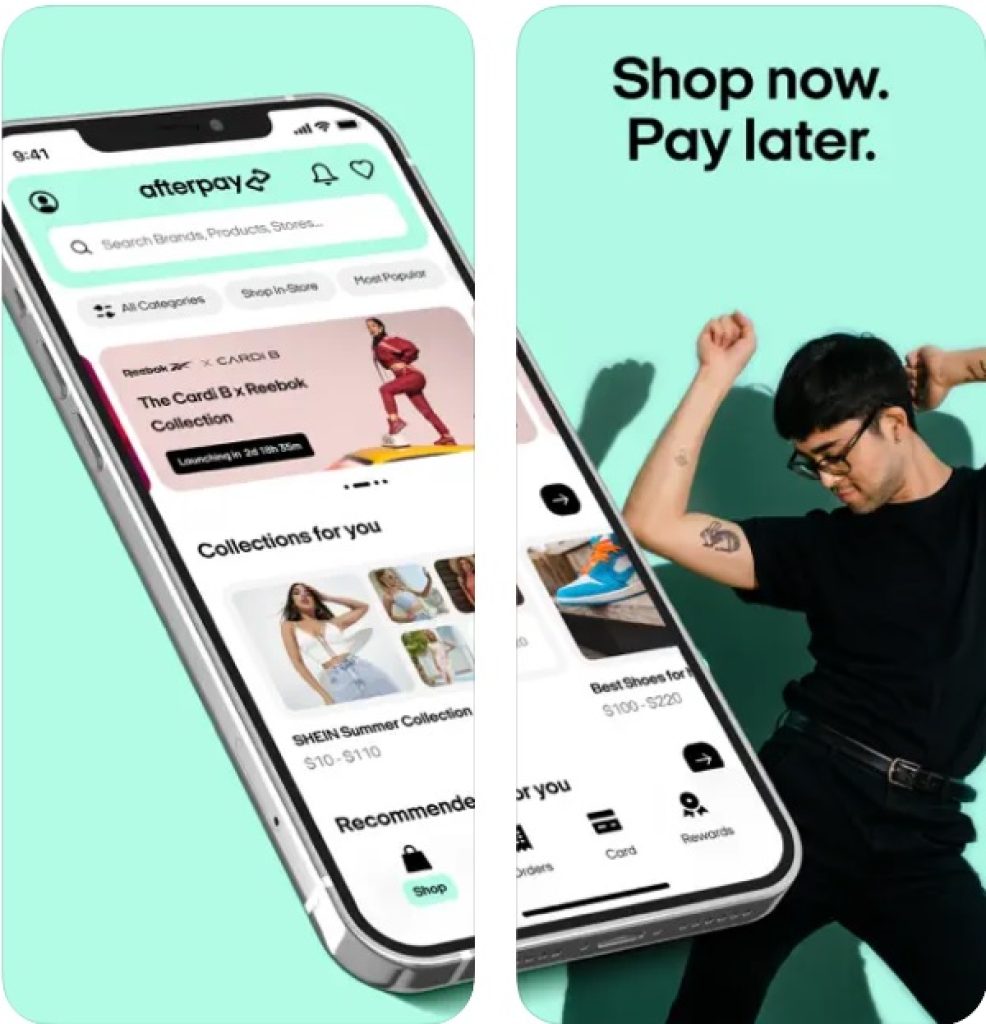

Afterpay

Have you ever met the problem of overspending? It is quite a typical situation among many users of Buy Now, Pay Later apps for clear reasons. However, if you still want to have a strict mentor watching your expenditure even among BNPLs, then Afterpay is definitely for you.

Here we have the widest range of restrictions possible. Firstly, it is a PayPal tween regarding payment terms – you can only opt for dividing your loan into four no-interest payments, the first to be done upfront.

The limit is very restrained – $600 only, but don’t worry: it will increase over time as soon as the system sees you spend your money responsibly.

Do you have trouble with meeting the deadlines? Afterpay is your private teacher in this kind of thing: pay $10 for your late installment if it is the first one and up to $7 afterward. Is it a discount offer? No, discipline always goes at full price, you know.

Any trouble with buying things you don’t need? Afterpay probably doesn’t have a partnership with the majority of retailers whose goods you may find unreasonable at a certain period of your life.

But with those that it does, it offers quite a solid discount, so you will still get what you want and save some additional money.

Do you have up to five shopping addict friends? Show them Afterpay and enjoy spending $10 for every invitation. Or actually, better save them for repaying late fees – again, no discounts on discipline!

Key features:

- One repayment plan

- No interest

- Strict purchase limit

- Late fees

- Restricted retailers list

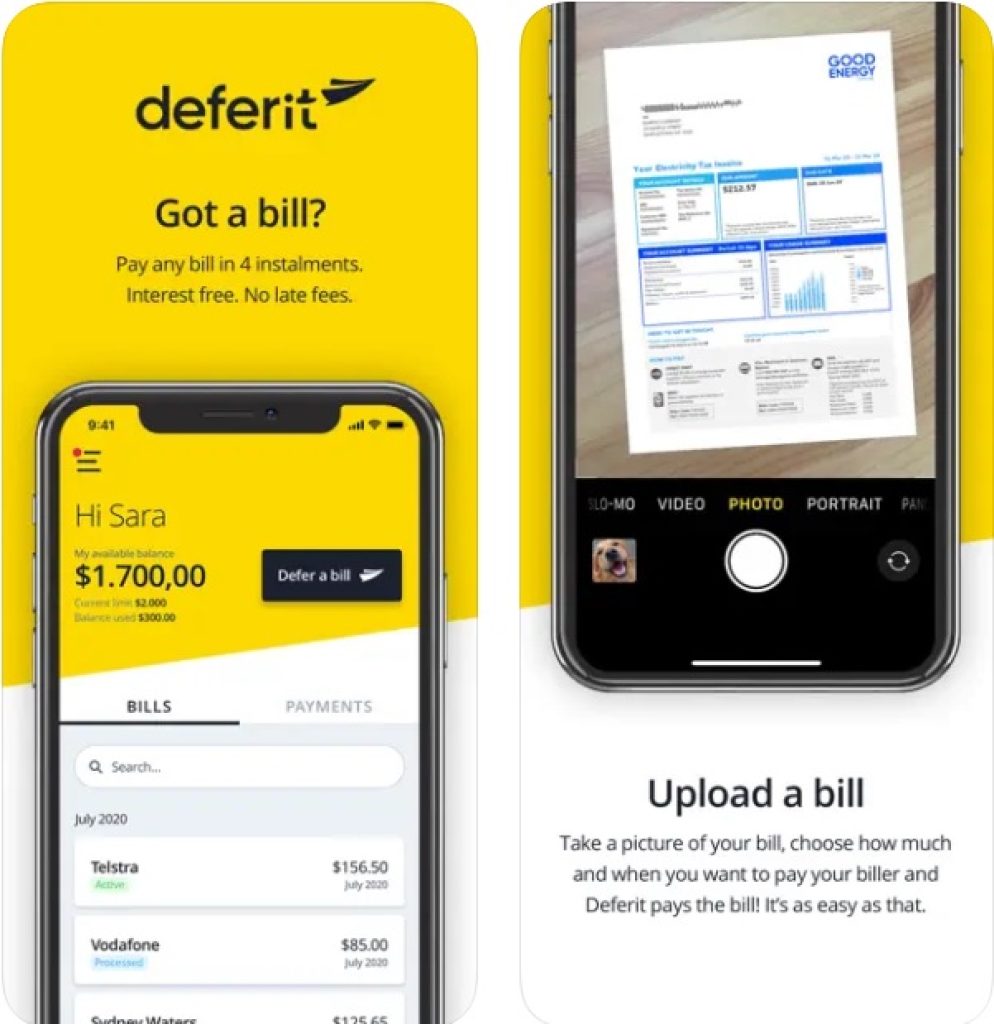

Deferit

The app’s name speaks for itself – what you do is simply defer the bill. But what are we here for if not splitting, deferring, and delaying our payments? How is Deferit different from the rest? Well, let’s see.

The plan Deferit offers is quite a basic option: it divides your bill into four equal parts, each of them charged zero interest rate.

A certain degree of flexibility is possible here too: although you can’t change the number of payments or opt for a more extensive repayment plan, you can choose any dates for four parts you will get for your loan.

Quite an interesting feature here: as soon as the app does not provide a virtual card, it is not the most convenient shopping option, but just take a look at how greatly it deals with bills!

Simply upload the bill either by taking a photo or adding a file – and let Deferit pay it! As the app’s motto says, “It’s as easy as that!”

Take a general look at all your bills or take a closer look at some specific ones by sorting them out by amount or date. It is a good tool to track basic payments and regular bills. However, if something goes wrong, keep calm and pay no late fees – just enjoy the life of a responsible loaner.

Key features:

- Good for bills

- One plan, flexible dates

- No interest, no fees

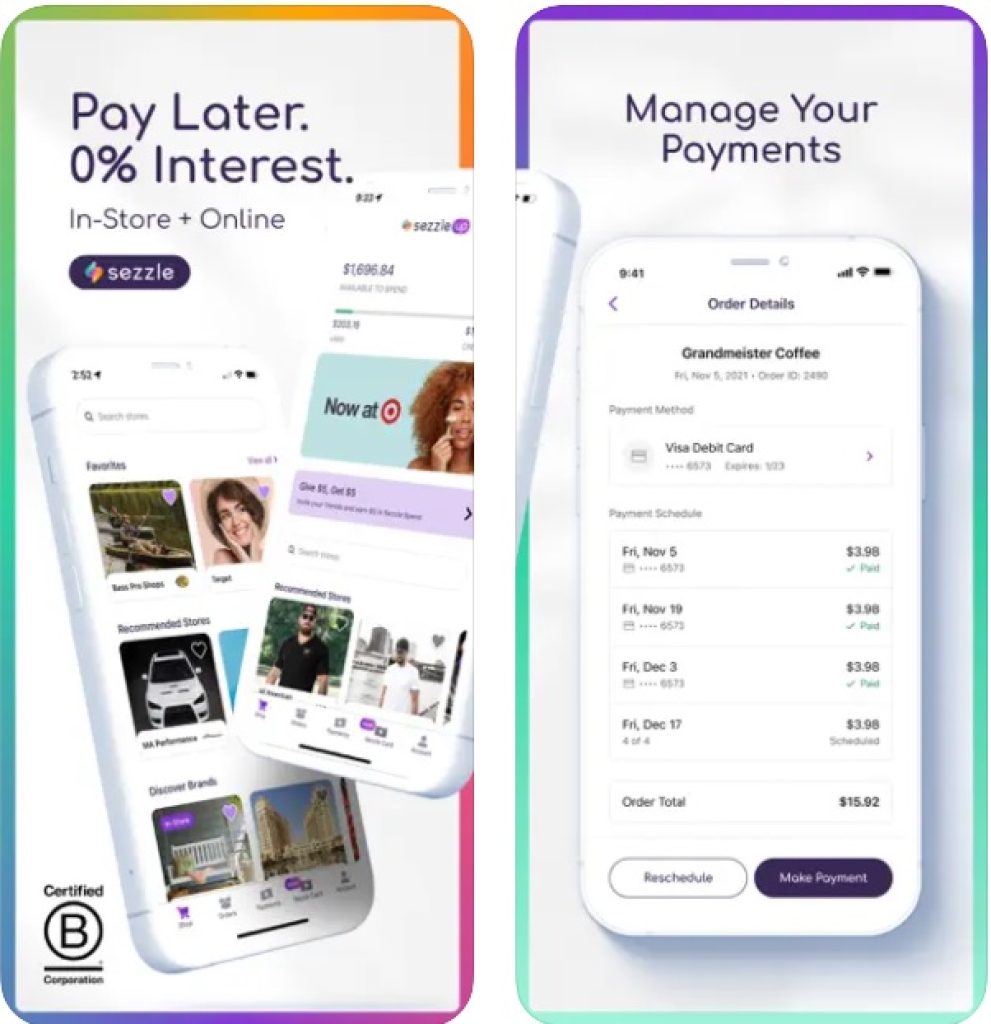

Sezzle

Imagine that everything goes smoothly: you’ve chosen the plan, started your repayment – and then you want to change your plan to elongate the period, but still not to make it too long. Meet Sezzle – the app for those who want room for changing their mind.

A basic option in Sezzle is quite typical: 4 payments, 6 weeks, no interest. You don’t like it? Choose a free reschedule advantage and reshape your plan: now you can pay the money back for up to two months. Once per order you can even do it for free, any further changes will require $5 each.

The purchase limit is $2,500, which is relatively low, but wait – it’s said per order. Does it mean you can have as many orders as you want? Technically yes, but it would be certainly more convenient to use Sezzle + Ally loan for up to $40,000 which you can repay for up to 60 months, albeit with possible interest rates.

When you opt for a short-credit option, you may often find similar tendencies: smaller credit – a more restricted list of retailers. On the one side, it is quite logical, but if Tesla decides to sell you a $2,500 car through this BNPL app, it probably won’t work out. Sorry Elon, better luck next time!

Key features:

- One repayment plan

- Reschedule opportunity

- No interest

- Technically no late fees

- Relatively low purchase limit

- A restricted number of partners

You may also like: 7 Best Money Counter Apps for Android & iOS

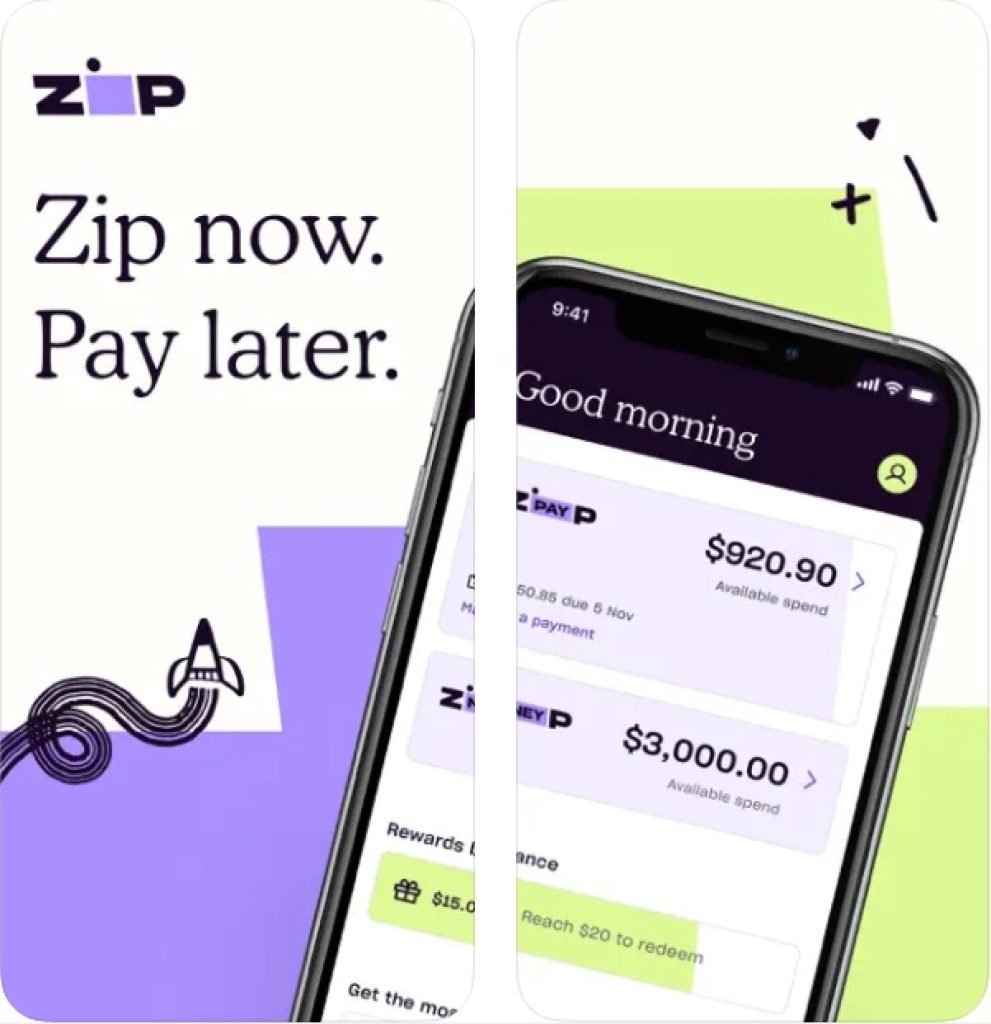

Zip

Have you ever heard of Zip? Don’t hurry with the answer: if you have heard the name Quadpay then it makes no difference. No matter how we call it, it is a Buy Now, Pay Later international service.

Like the majority of apps of the type, Zip doesn’t provide credit bureaus with loan reports, so you don’t have to care about your credit score while shopping.

Zip offers the following repayment plan: four no-interest payments done over six weeks. Quite unusual, haven’t seen this before, right? However, this basic and familiar option hardly corresponds with additional requirements.

Firstly, you will have to pay $4 for every purchase and $1 for every payment. Isn’t it too much, especially when there are many other good no-fees options? Secondly, late fees are also included: Zip charges $7 for each late payment.

Quite a controversial situation. On the one side, no interest and partnership with more than 51,000 retailers, such as Wrangler, North Face, and Target.

On the other hand, transaction fees… Well, Zip would fit greatly into some philosophical value system – who would teach you to be generous better than the app that charges $5 each time you use it?

Key features:

- Pay in 4 plan

- No interest

- $4 for every transaction

- $1 for every purchase

- Maximum purchase limit set by retailer

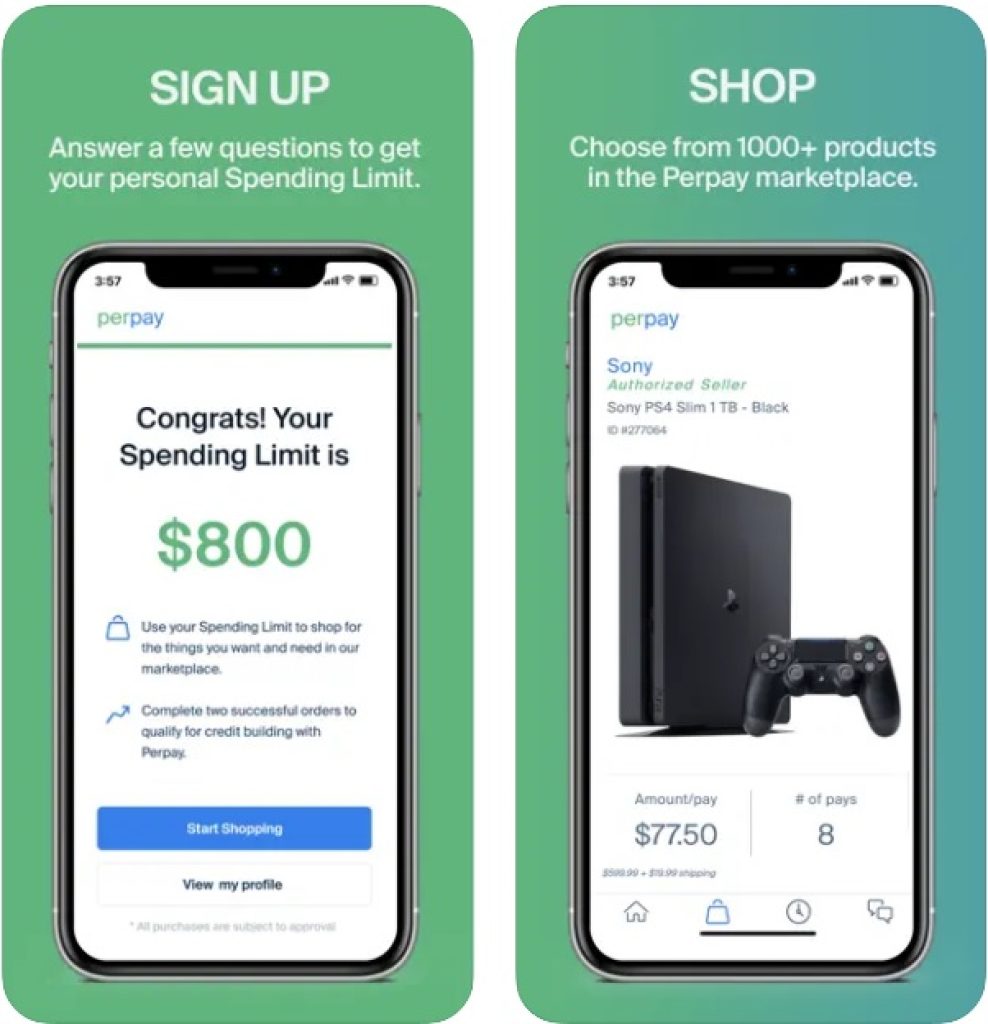

PerPay

When it comes to Buy Now, Pay Later apps, it is all about trust. PerPay is the service that is going to believe you even if you had been a bad guy in the past. How does this almost human trustworthiness work?

Firstly, let’s start with the basics. As for the plan, PerPay gives you a loan divided into twelve equal payments (however, you will be able to choose the number of installments yourself).

It can seem that such a prolonged period corresponds with costly purchases, otherwise why divide into so many parts? However, the limit only reaches $2,000.

Are you interested? Well, you don’t have enough information for now, but note that PerPay is not interested in charging you additional money: a repayment plan doesn’t presuppose any interest or late fees.

What’s the ambiguity then? The thing is that PerPay doesn’t require your credit score, as many BNPL apps do. So if you hadn’t been a responsible client in the past, it’s high time you became one now. Show them your eligibility, employment, and no less than $15,000 annual income – and enjoy!

Key features:

- 12-month installment plan

- No interest

- No late fees

- Good for a bad credit score

- Specific requirements

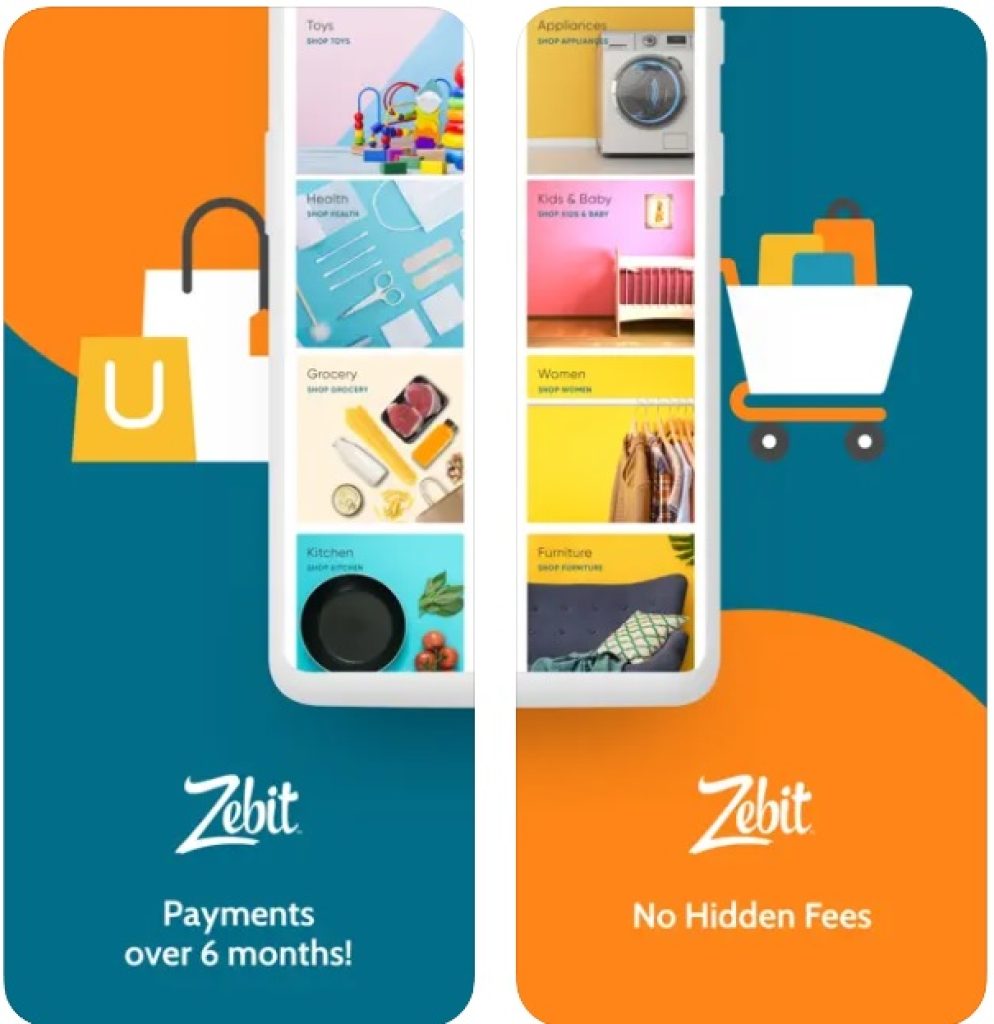

Zebit

Another opportunity for bad credit scores. As for prerequisites to qualify, Zebit is quite similar to PerPay. Though you don’t have to present your credit score, you must be of age, employed, and possess a solid income.

You don’t need to provide the service with any credit score data, as well as the app won’t reveal anything harmful to your credit history.

Let’s move to the terms. With Zebit you can take loans up to $2,500 and repay them during the following six months. What’s important is that Zebit doesn’t have any fixed purchase limit: it may change according to your payment history.

How much money you will have next time depends on whether you can return it in time.

As you could have noticed, Zebit can hardly boast of big sums of money provided to clients. On the other hand, it doesn’t charge any interest and doesn’t have any hidden fees.

So, does it mean that Zebit is just a basic BNPL app with quite a restricted number of functions? Well, it could be so if it were a classic service of the type, but note that Zebit is a marketplace.

It is a big platform with various categories of goods that you can buy directly from the website and pay for them later. Major categories are electronics, appliances, and furniture. So if you searched an online store with a BNPL option, it seems that you are on the right way.

Key features:

- A marketplace, not a common BNPL service

- Restricted spending limit

- No interest, no fees

- A credit score is neither required nor affected

Sunbit

We have to admit that the majority of Buy Now, Pay Later apps have partnerships with shops where you can buy things and very rarely access services. What do we have to do if we need the help of, for example, dental or retail specialists? It seems that we have just to Sunbit it!

Sunbit is an app that is built for local and everyday needs. It provides a partnership with major specialists in such spheres as dental care, optical care, veterinary, retail service, and auto service.

You can log in within 30 seconds by just providing your driving license or state-issued ID and filling in some additional data including your e-mail address.

Once you’ve logged in, you will be able to see the amount of money you are allowed to borrow. With Sunbit you can take a loan of up to $20,000. Mind that every offer is special and individual, what’s more, an average expenditure rarely exceeds $1,500.

Next, choose your repayment plan. Sunbit allows you to choose 3-, 6- and 12-month payments. You will see how much you are going to pay and when it will happen. After paying the first deposit upfront and signing a virtual contract you may enjoy accessing many essentials all in one place.

Key features:

- No credit score required

- No fees

- 0-35.99% APR

- Limited services to use

Scratchpay Plans

Another option to split your bill if you opt for a medical checkup. Scratchpay is a service made specifically for kicking medical bills not only for you but also for your four-legged friend.

Whenever you need a new vet expenditure to be done or to pay for yourself, you just have to apply for a loan which you will pay directly to the office of your specialist.

Scratchpay offers various plans. You can split your bill and pay it back from half a year to 5 years. The APR you will be charged depends on your credit score. The app requires it, but will not influence it. How much money you will get and how long you will be repaying it depends much on your credit score too.

The service technically doesn’t charge late fees. However, if there are any additional expenditures or you will just have another checkup, you will have to take another loan. If you hadn’t paid in time, mind that the app may charge you a higher APR, which will de facto be your late fee.

If you are in doubt about which specialist to consult, Scratchpay has a database of medical practices in physical therapy, primary care, dermatology, dental, veterinary, vision, cosmetic surgery, and many more organizations that are the partners of the service.

Key features:

- Specifically for medical expenditures

- High APR charged

- Plans are based on credit score

- Database of more than 11,000 practices

Four

Four is a favorite number among Buy Now, Pay Later services. How many times you have already heard about the Pay in 4 option? It seems that in this article only you’ve met it at least a thousand times. And here’s one thousand and one – Four app!

Four is a marketplace that has quite an extensive database of partners including men’s and women’s ready-made clothes stores, beauty shops, accessories, and pets’ goods.

Likely, you won’t find something basic such as Sephora or H&M here, but for many people, Four has become an opportunity to get acquainted with new curious little companies.

With Four you don’t have to worry about your credit score. The service doesn’t require your credit history and doesn’t influence it either. 1 Click Checkout featured option helps you pay for your purchases without filling in long registration forms.

Select Four at the checkout and pay one time upfront, then in 2 weeks, in 4 weeks, and finally in 6 weeks. Pay your loan back with a debit or credit card, Apple Pay, or Google Pay.

Key features:

- An extensive database of stores

- No credit history required

- No check-in process

You may also like: 16 Best money transfer apps for Android & iOS

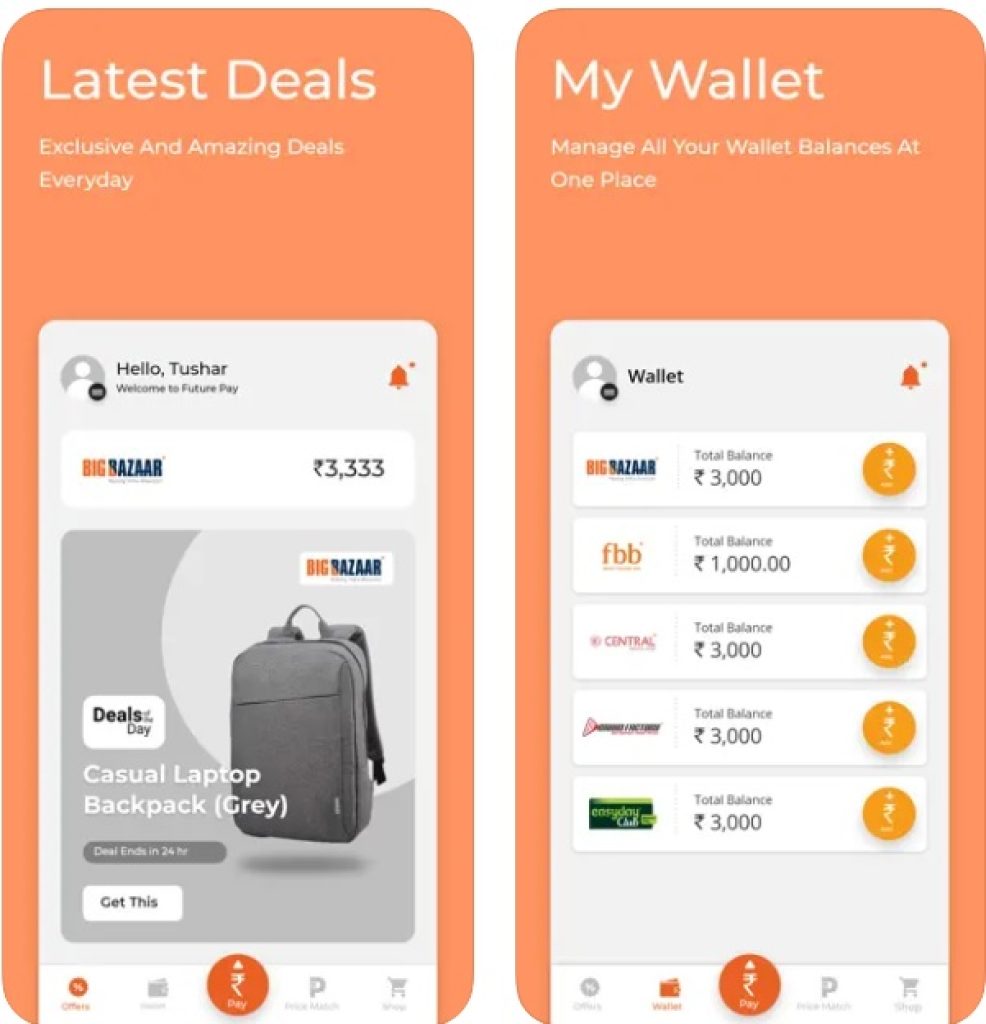

Future Pay

Future Pay is the name that speaks for itself. The key word here is future – and they mean it when they call it a Pay Later app. With Future Pay’s feature called MyTab, you can forget about weekly or monthly payments and carry your ‘tab’ basically as long as you want.

How does it work? Well, Future Pay doesn’t care how much you borrow and how much you spend. The only requirement is that you have to pay $20 each month. Of course, if you decide to repay your loan all at once, there won’t be preventing you from doing so.

Key features:

- Available only for Future group stored

- $1.25 Fixed Finance Charge for each $50 increment

- No interest