Tax time is never fun, but for legally obedient citizens this may seem particularly difficult. Business receipts, travel logs, unpaid invoices, refunds, and all other items that need to be tracked can be huge.

Fortunately, the digital age has provided tools to facilitate tax time. Even better, many of these tools can now travel with you on your phone. Here are 7 Best tax return apps to help you keep track of expenses, manage your books, and generate taxes.

You may also like: 11 Credit Repair Apps (Android & iOS)

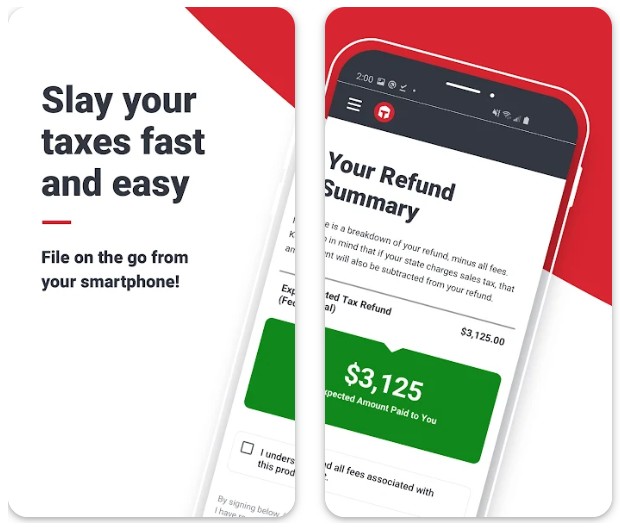

TaxSlayer

TaxSlayer is a tax filing software. The application offers various features that make filing taxes easier. The software can help you file federal and state tax returns, access tax forms, and check the status of your refunds.

You can enter your tax information manually or take a photo of your W-2 using your mobile device’s camera. The app also offers helpful tips and advice throughout the entire application process.

While the app has many useful features, some users note that it can be slow at times and customer support can be difficult.

Additionally, some users expressed dissatisfaction with the app’s fees and the fact that it might not be as thorough as a tax specialist.

Application features:

- Simplifies work with taxes and declarations

- Simple and easy to use application

You may also like: 11 Best QuickBooks Apps for Android & iOS

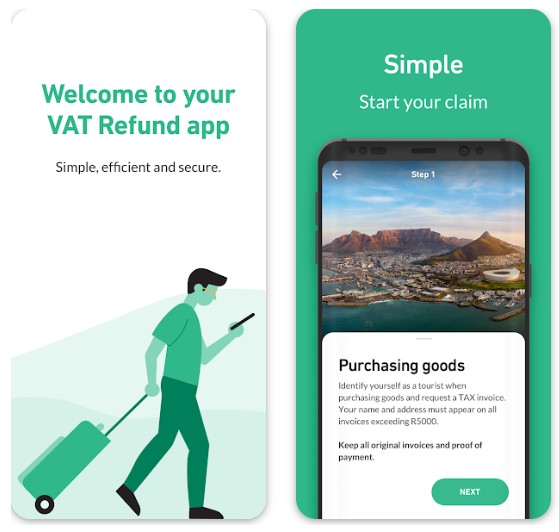

Refresh Tax Refund

Refresh Tax Refund is an application that will help you work more comfortably with taxes. The app provides a convenient way to apply for a tax refund online.

The app’s main features include a tax calculator that helps you calculate an estimated tax refund based on their income and deductions.

The app also allows you to fill out and submit tax return forms that are automatically filled in with your personal information. In addition, you can track the status of your refund and receive notifications when it is processed.

One of the app’s strengths is its ability to simplify the tax refund process, which can be complex and time-consuming. You can avoid the hassle of filling out forms by hand and waiting in long lines at the tax office.

However, some users have reported performance issues with the app, including slow downloads and crashes. Some have also complained about the app’s customer support, which they feel is unresponsive.

While there may be some issues with its performance and customer support, the app’s ease of use and useful features make it a viable option for you if you want to streamline your tax refund process.

Application features:

- Simplifies work with taxes and declarations

- Simple and easy to use application

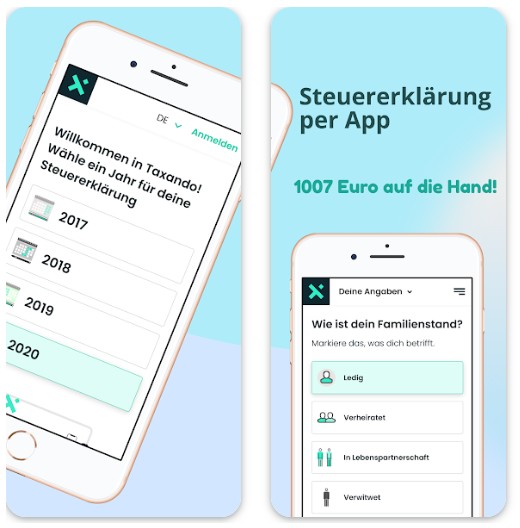

Taxando

Taxando will help you calculate taxes on your income, expenses and investments. Now you do not need to do it yourself or contact special services.

The app allows you to easily calculate your taxes based on your income and expenses. You can enter your income and expenses in various categories such as salary, rent, utilities and more.

The app then calculates tax liabilities based on location and tax laws.

In addition to income and expenses, Taxando also offers investment tracking. You can enter your investments and the application will calculate the tax liability on the profits and losses from these investments.

Some users are known to note that the app may not be as accurate as professional tax preparation services. Additionally, some users have reported issues with the application crashing or freezing.

Taxando is a useful tool for individuals who want to quickly and easily calculate their tax liability, but keep in mind that the application is not perfect and can make mistakes.

Application features:

- Allows you to easily calculate your taxes

- Easy to use app

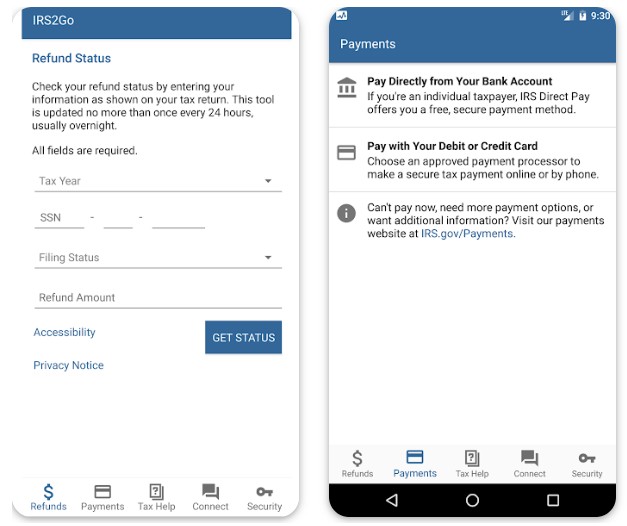

IRS2Go

IRS2Go app is a mobile app developed by the Internal Revenue Service that allows you to access various IRS services directly from your smartphone or tablet.

With this app, you can check the status of your tax refund, make tax payments, request a tax statement, and find IRS taxpayer help centers. You can also sign up to receive tax advice and updates from the IRS.

One downside of the app is that it may not be as user-friendly as other tax preparation apps on the market. Some users have also reported technical issues such as login difficulties and error messages when trying to access certain features.

Negative comments about the application are often related to technical problems and dissatisfaction with its functionality. However, many users find the app useful and convenient for managing their taxes on the go.

IRS2Go is a useful tool for taxpayers who want to manage their taxes from their mobile devices. While there may be some technical issues to be aware of, many users find the app a valuable resource for accessing IRS services.

Application features:

- Easy to use

- Helps you simplify your work with taxes and declarations

Application cons:

- Frequent technical failures

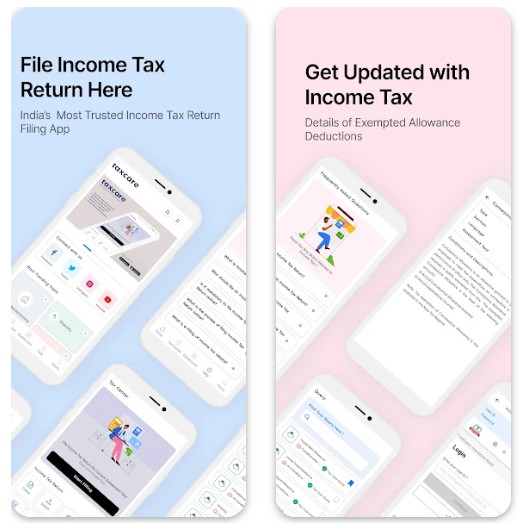

Taxcare

Taxcare is designed to help you keep track of your taxes and financial statements. The application is intended for use by individuals and small businesses.

Now you don’t have to worry about bookkeeping for a long time, the application will do this job for you.

One of the key features of the Taxcare app is the ability to track expenses and income. You can enter information about your financial transactions and categorize them for convenience.

The app can also generate reports and summaries based on this data, which can be useful for tax preparation and budgeting.

In addition to tracking expenses, the Taxcare app offers a number of other features.

You can set reminders for upcoming tax dates and appointments, create and manage invoices, and scan receipts and documents using your smartphone’s camera.

Despite a number of advantages, this application is not ideal and has a list of disadvantages. Some users have reported problems with the application crashing or freezing, while others have noted that it can be slow to load at times.

Also, the app may not be suitable for those who require more advanced accounting and bookkeeping features.

Despite these potential downsides, many users have praised the Taxcare app for its ease of use and useful features.

Some negative reviews note that the app can be somewhat limited in terms of customization options, but overall it seems like a useful tool for those who want to manage their finances and taxes on the go.

Application features:

- Easy to use app

- Suitable for self-calculation of taxes and income

Application cons:

- Has insufficiently broad functionality

You may also like: 11 Best expense tracker apps for Android & iOS

TurboTax

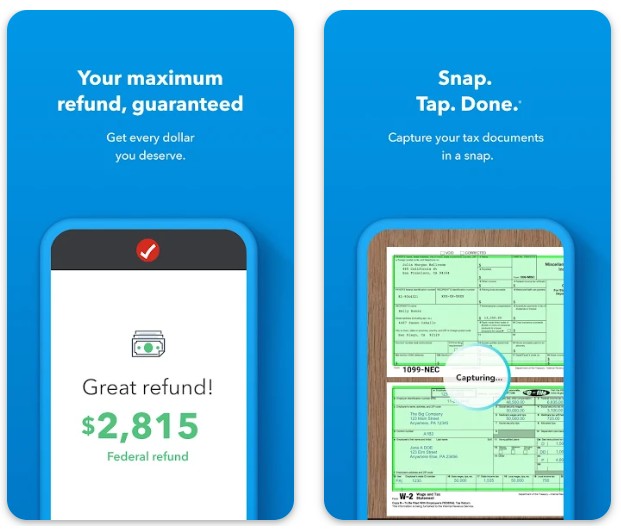

TurboTax – Helps users file tax returns. The app is designed to simplify the tax filing process by helping you through every step of the process, from entering personal information to determining deductions and credits.

One of TurboTax’s key features is the ability to import tax information directly from W-2 forms and other tax documents, eliminating the need for manual data entry.

It also offers many tools and calculators to help you calculate your taxes accurately and maximize your refund.

The app also includes a feature called “SmartLook” that connects you with real tax experts who can answer any questions they have and provide personalized assistance.

TurboTax also offers various support resources, including video tutorials and a community forum.

Оne of the potential disadvantages of the app is its cost. While the app is free to download, users must pay a fee to file tax returns through TurboTax.

In addition, some users report technical problems or crashes in the application, although such problems are relatively rare.

Negative comments about TurboTax are often related to its cost, with some users feeling that the fees are too high. Others criticize the app’s customer support, which can be difficult to contact during peak tax season.

All that being said, TurboTax is a useful tool for anyone looking to streamline their tax filing process.

While it may not be the cheapest option available, it does offer a number of features and support resources that can help you navigate the intricacies of the tax code.

Application features:

- Simplifies work with taxes

- Convenient to use

Cons in the application:

- Subscription required for more features.

- Periodic technical problems.

H&R Block Tax Prep

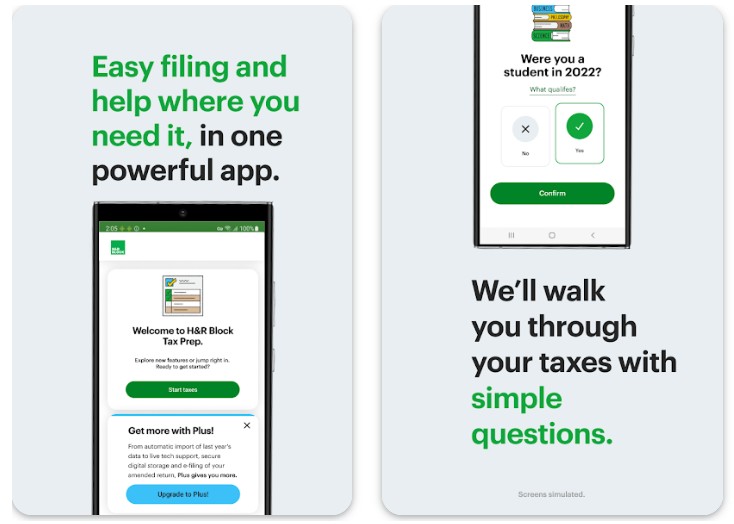

H&R Block Tax Prep app is a virtual tool to help you easily prepare and file your tax return.

The app offers a range of features to make the process of filing your tax return easier, including a step-by-step guide to guide you through each section of your tax return.

One of the app’s standout features is its ability to import tax information for previous years, making it easy for users to accurately fill out tax returns. The app also allows you to take a photo of your W-2 form to automatically complete the relevant information, saving you time and effort.

In addition to basic tax preparation features, the app includes a range of tools and resources to help you understand complex tax rules and maximize your tax refund.

You can access real-time tax advice and guidance from tax experts, as well as a variety of educational resources such as tax calculators, articles, and videos.

Despite many useful features, some users of this application have reported problems with the application’s user interface, citing difficulty navigating through certain sections and slow loading.

In addition, some users have expressed dissatisfaction with the app’s support team, citing long waiting times and unhelpful support representatives.

In conclusion, H&R Block Tax Prep is a useful tool for anyone who wants to simplify the process of preparing tax returns, but it is important to remember that the application may not be perfect and some users may experience problems or frustrations.

Application features:

- Easy to use app

- Suitable for self-calculation of taxes and income

Application cons:

- Has insufficiently broad functionality

Taxfix

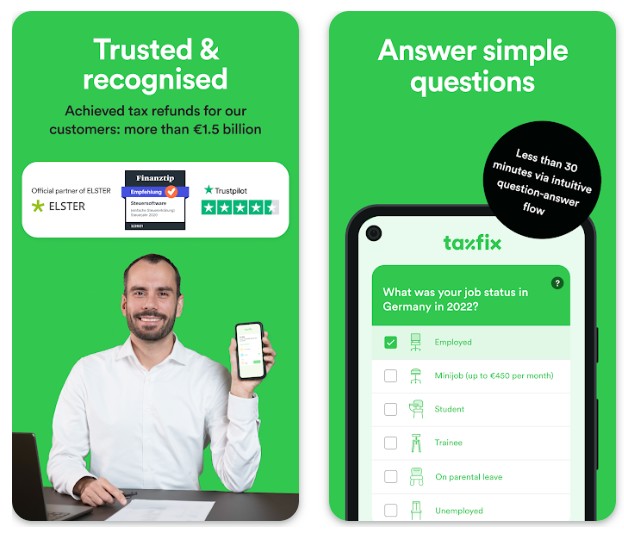

Taxfix – helps you file your taxes with ease. This mobile app simplifies the tax filing process by providing a user-friendly platform that allows you to file your taxes in just half an hour.

The application’s features include a step-by-step guide to filling out the tax form, automatic tax calculation, and submission to the relevant tax authorities.

You can also upload your documents using the app and receive personalized support from tax experts.

One of the features of the app is its ability to identify potential tax savings for its users. It checks all possible tax deductions and credits that you may be eligible for as a user, ensuring that users receive the highest possible tax refund.

However, this application has some disadvantages. For example, it is only available for use in a few countries, including Germany and Austria. In addition, some users report technical glitches when using the app, which can be frustrating.

Negative comments about an app are usually related to user interface issues or customer support issues. Some users have reported difficulty navigating the app, while others have complained about the slow response time of the support team.

All in all, Taxfix is a useful app for those who want to streamline their tax filing process.

Its intuitive interface and automated features make it an attractive option for those who are comfortable using technology to manage their finances. However, its limited availability and occasional technical issues may put some users off.

Application features:

- Simplifies work with taxes

- Convenient to use

Cons in the application:

- Subscription required for more features.

- Periodic technical problems.

You may also like: 11 Best apps to balance checkbook for Android & iOS

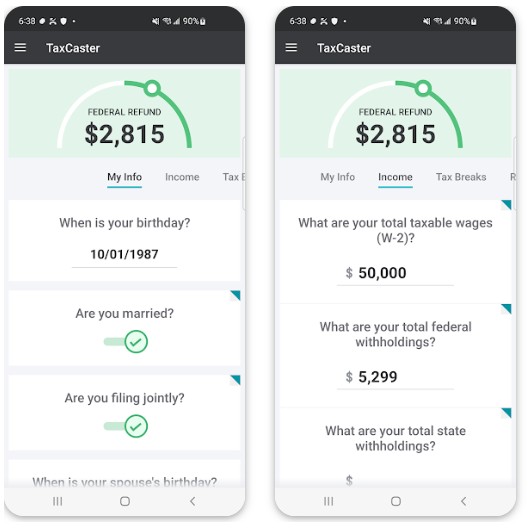

TaxCaster

TaxCaster is an app for calculating taxes. The app will evaluate your federal income tax refund or help you owe it to tax. You can easily submit your income, deductions and credits, and receive income from your tax liability for the year.

TaxCaster is collection friendly and easy to navigate. You can quickly switch between scenarios to see how the income, deductions, or credits associated with your tax liability change.

The application also allows you to get an assessment and a solution to their problems.

One of the app’s strengths is its accuracy. TaxCaster is based on the same tax calculator used by TurboTax. Therefore, you can be sure that your assessment is reliable.

However, applications have occurrences. For example, TaxCaster does not provide government taxes. In addition, the application may provide tax credits or deductions that include some tax liabilities.

Therefore, it is best to use the TaxCaster as a rough estimate and present it to a tax professional for a more accurate estimate.

Some users have used push notification services and used app ads. However, they can be easily run into applications.

TaxCaster is commonplace for your federal income tax obligations. While it has its limitations, it can help you plan ahead and make sound financial decisions.

Application features:

- Easy to use

- Helps you simplify your work with taxes and declarations

Application cons:

- Frequent technical failures